- +39 3406487807

- studioartem@studioartem.it

Содержание

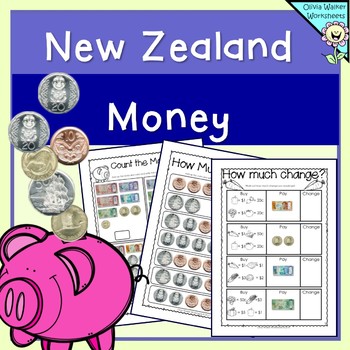

Mimo iż Dania jest członkiem Unii Europejskiej nie ma waluty euro. Na mocy traktatu z Maastricht została zwolniona z obowiązku wymiany waluty. Powodem było odbyte w 2000 roku referendum, w którym ponad połowa społeczeństwa odrzuciła pomysł wprowadzenia nowej waluty – euro. Korona stała się środkiem płatniczym w 1873 roku w wyniku stworzenia Skandynawskiej Unii Monetarnej. Po i wojnie światowej rozpadła się, jednak państwa na pamiątkę postanowiły zachować walutę.

Dania jest zwolniona z obowiązku wprowadzenia u siebie waluty Euro. W przeprowadzonym referendum ponad 53% Duńczyków opowiedziało się przeciwko europejskiej walucie. Dania jest krajem zwolnionym z wprowadzenia u siebie waluty euro.

.jpeg)

W koronę duńską warto jednak zaopatrzyć się jeszcze przed wyjazdem. Jej zakup nie powinien stanowić problemu, a w przypadku skorzystania z naszego portalu zaowocuje to oszczędnością dzięki atrakcyjnemu kursowi DKK/PLN. 50, 100, 200, 500 i 1000 – to nominały banknotów koron duńskich . Na serii wyemitowanej w 2006 roku widnieją słynne budowle mostowe, a na tym najcenniejszym umieszczono 18-kilometrowy Great Belt Fixed Link, konstrukcję, która łączy wyspy Zelandię i Fionę. Na odwrotach znajdują się z kolei znane i cenne zabytki Danii.

Wyjazdy do Danii w celach turystycznych są coraz powszechniejsze. To ciekawy kraj z wieloma miejscami, które warto odwiedzić. Duże miasta dają wiele możliwości, jeśli chodzi o zwiedzenie czy atrakcje, małe natomiast dostęp do pięknej przyrody czy wspaniałych tras rowerowych.

Następnie podczas drugiego największego światowego konfliktu zbrojnego waluta Danii była połączona z marką niemiecką, a po zakończeniu wojny z funtem brytyjskim. System z Bretton Woods kilka lat później połączył kurs DKK Der NASDAQ-Index, auf den Sie auf den Internetindex z dolarem amerykańskim, jednak po jego rozpadzie kurs korony duńskiej przestał być stabilny. Powyższa tabela przedstawia proponowany kurs wymiany korony duńskiej kolejno na polskie złotówki, euro i amerykańskie dolary.

W zakładce Kantory Warszawa, a następnie udaj się do wybranego oddziału – w każdym z nich obowiązują takie same ceny. Śledź kurs korony duńskiej na wykresie i obserwuj trendy. Warto wspomnieć również o niezwykłej tradycji dotyczącej wyglądu banknotów i monet. Korona duńska od lat wygląda okazale, a modyfikacje wprowadzane są regularnie. W przypadku banknotów ostatnio zapoczątkowaną serią są duńskie mosty/zabytki archeologiczne z duńskich muzeów. Jako przykład można podać ten o nominale 50 koron (most nad cieśniną Salling), 100 koron czy 500 koron (Most Królowej Aleksandry).

Oficjalnym środkiem płatniczym Danii korona duńska stała się w 1873 roku po zawarciu Skandynawskiej Unii Walutowej. Poza Danią, znalazły się w niej Szwecja oraz Norwegia. Rozpad Unii nastąpił po pierwszej wojnie światowej, jednak państwa tworzące Unię postanowiły zachować główną nazwę „korona” w swoich narodowych walutach.

.jpeg)

Kadencja prezesa narodowego banku Danii nie ma określonej długości. Szef instytucji emitującej duńską koronę jest nominowany przez panującego monarchę i piastuje swoje stanowisko, aż do ukończenia 70 roku życia, kiedy to musi ustąpić. 1873 – Dania i Szwecja tworzą wspólną Unię Monetarną (do której wkrótce dołącza Norwegia) i jako wspólną walutę ustalają właśnie koronę. Co ciekawe każde państwo biło jej własną wersję. 1618 rok – pierwsze próby oparcia duńskiego systemu monetarnego o złotą i srebrną koronę. Nie przetrwał on długo, no już po roku wprowadzono zmiany.

Jeśli chodzi o walutę Danii, warto po prostu wiedzieć o pewnych sprawach, dostosowując do nich swoje działania. Otrzymuj codziennie komentarze walutowe na Twojego maila! Nasi eksperci analizują najważniejsze informacje ekonomiczne, polityczne, gospodarcze i ich możliwy wpływ na kurs korony duńskiej. Na banknotach korony duńskiej nie znajdziemy postaci historycznych. Wykres, odświeżany co 5 minut, przedstawia bieżący oraz historyczny kurs korony duńskiej, prezentowany w odstępach 15-sto sekundowych.

.jpeg)

W Danii szczególnie popularne są karty Dankort, które w niektórych miejscach bywają jedyną akceptowaną formą płatności. 500 koron – Most Queen Alexandrine, most drogowy przecinający Ulv Sund pomiędzy wyspami Zelandii i Møn w Danii. Wyrażam zgodę na przetwarzanie moich danych osobowych w zakresie adresu mailowego na wysyłanie kodu rabatowego, zgodnie z ustawą o świadczeniu usług drogą elektroniczną. Wyrażam zgodę na otrzymywanie drogą elektroniczną na wskazany przeze mnie adres e-mail informacji dotyczących alertu walutowego.

Korona duńska występuje w Danii, na Wyspach Owczych oraz na Grenlandii. Te drugie mają własną walutę (koronę Wysp Owczych), ale duńskie korony funkcjonują tam równolegle z nimi. Znacząco różnią się od Dow Jones Industrial Average Greets kamień milowy na 20 000 siebie wagą, rozmiarem i surowcem, z którego zostały wykonane. Monety o wartości 1, 2 i 5 DKK mają specyficzną dziurę w centralnym punkcie, co pozwala łatwo odróżnić je od innych osobom niewidomym.

Powód jest prosty – gospodarka Danii jest ściśle powiązana z gospodarką UE. Jednostką monetarną w Danii jest korona duńska , gdzie korona to 100 ore. Obiegowe banknoty są wartości 50 DKK, 100 DKK, 200 DKK, 500 DKK i 1000 DKK, a monety 20 DKK, 10 DKK, 5 DKK, 1 DKK oraz 50 øre i 25 øre. Korona duńska obowiązuje także na Wyspach Owczych oraz Grenlandii. Jednak na na Wyspach Owczych wzory na banknotach są inne.

Korony duńskie są oficjalną duńską walutą i można dokonywać płatności tymi banknotami w Danii, Grenlandii i na wyspach Owczych. Na mocy traktatu z Maastricht Dania została zwolniona z wprowadzenia euro na swoim terenie. Wolę tę naród duński podtrzymał w referendum przeprowadzonym w 2000 roku.

Euro stało się walutą Unii Europeiskiej 1 stycznia 1999, jednak Dania zdecydowała się nie wprowadzać EURO we własnym kraju. Zagraniczni goście mogą płacić w EURO w Danii za pomocą karty kredytowej ponieważ monety i banknoty nie znajdą się w obiegu do 1 stycznia 2002 roku.

Przeszłość ukazana jest przez pięć charakterystycznych prehistorycznych obiektów, znalezionych w pobliżu mostów, a teraźniejszość przez same mosty. Korona duńska została wprowadzona za panowania Chrystiana IX (około 1900 roku). Dania na mocy traktatu z Maastricht jest krajem całkowicie zwolnionym z obowiązku wprowadzenia euro.

Jeśli twoim celem jest Dania, waluta tam obowiązująca – korona duńska – powinna trafić do twojego portfela. Sprawdź, jakie są najnowsze kursy, a także jak wyglądają kwestie kupna/sprzedaży, a także ewentualnych zakupów na terenie Danii. Nasza firma oferuje jedną z najbogatszych tablic walutowych w całej Polsce – w sprzedaży posiadamy ponad 60 walut z całego świata! Większość z nich, w tym także waluta Danii – korony duńskie – jest u nas dostępna od ręki.

Należy również wziąć pod uwagę fakt, że wypłata gotówki poza granicami kraju często wiąże się z naliczeniem dodatkowych opłat. Realizacja transakcji przy pomocy kart debetowych oraz kredytowych jest możliwa w większości miast, hotelach, restauracjach, barach, czy sklepach. Jednakże wybierając się na odległe prowincje warto posiadać niezbędną gotówkę, gdyż może wystąpić sytuacja, w której płatność kartą będzie niemożliwa. W Danii występują karty debetowe Dankort, które w niektórych miejscach bywają jedynymi akceptowalnymi kartami. Nie można wymienić tych banknotów w banku lub w kantorze wymiany walut oraz nie można dokonywać płatności tymi banknotami w Grenlandii i na wyspach Owczych.

Kartami płatniczymi i kredytowymi można regulować należności w hotelach, restauracjach, sklepach i kawiarniach. 1000 koron – różowy banknot, przedstawiający na awersie most przez Wielki Bełt, łączący Zelandię z Fionią, a na rewersie brązowy wóz słoneczny z Trundholm. W 1619 roku zmieniono system płatniczy, a talara lewkowego zastąpił wówczas większy rigdaler in specie, zawierający 25.88 gramów srebra. Talar lewkowy pod nazwą sleddaler stał się jednostką obrachunkową równą 4 marki. W kolejnych latach stopniowo zmniejszano zawartość srebra w srebrnej koronie i złota w złotej.

Już w średniowieczu Duńczycy posługiwali się złotymi koronami. Następnie dominowały duńskie talary, aż w 1873 roku Dania wraz z innymi państwami Skandynawii zawarły unię monetarną, wprowadzając wspólną walutę – koronę. Początkowo kurs DKK ściśle zależał od cen złota, którego domieszkę zawierały, a następnie od funta szterlinga. Nie ma sensu Forex dzisiaj: zapasy, towary poślizgnięcie się w cichym handlu zabierać ze sobą na przykład euro, ponieważ kurs wcale nie musi być lepszy, niż w Polsce. Ze złotówkami warto jednak uważać, ponieważ nie każdy duński kantor będzie je w stanie przyjąć. Choć kraj ten jest w Unii Europejskiej, nie zdecydował się na przyłączenie do Strefy Schengen, co komplikuje nieco sprawę płatności i wymiany walut.

Zastrzegamy jednak, że kursy walut podane w artykule nie są zmieniane na bieżąco, a ostatnia aktualizacja treści miała miejsce w maju 2022 roku. Przed podjęciem decyzji o zakupie należy sprawdzić aktualny kurs wymiany na stronie korony duńskiej. Pierwsza waluta w Danii z koroną w nazwie pojawiła się w 1584 roku. Po jej rozpadzie powstała dzisiejsza duńska korona. Na czas II wojny światowej kurs korony duńskiej połączony był z niemiecką marką, a po jej zakończeniu kurs DKK powiązano z funtem brytyjskim.

Przeglądaj najnowsze wiadomości z rynku, najciekawsze artykuły i najważniejsze ogłoszenia. Umożliwia zbieranie statystycznych danych na temat tego, jak korzystasz z naszej strony. Zapamiętuje ostatnio wybraną walutę w usłudze ofert społecznościowych . Rejestruje unikalny numer użytkownika służący do zbierania statystycznych danych na temat tego, jak korzystasz z naszej strony.

1 DKK = 0.6337 PLN.

Kurs korony duńskiej zwykle nie wykazuje dużych zmienności na wykresach. Waluta DKK jest ważna dla emigrantów oraz turystów. Jeżeli wybierasz się do Danii, sprawdź przed wyjazdem, ile kosztuje korona duńska. Nowa waluta w naszym serwisie to wyjście naprzeciw oczekiwaniom klientów.

Kurs korony duńskiej w NBP zmienia się każdego dnia roboczego. Aktualne notowania kursu korony duńskiej są mocno związane z kursem euro – jeżeli więc złoty osłabia się wobec europejskiej waluty, to traci także wobec korony duńskiej i odwrotnie. Kurs korony duńskiej na wykresie jest prezentowany dla celów orientacyjnych, w oparciu o przybliżone dane i nie ma charakteru transakcyjnego tzn. Nie stanowi ze strony serwisu elementu oferty ani propozycji zawarcia transakcji. Kurs korony duńskiej jest ściśle związany z kursem Euro. Pomimo różnych wartości notowań kursy zachowują się identycznie, zachowują wspólne trendy.

Author: Julie Hyman

On Monday, Treasury Secretary Janet Yellen reaffirmed that the U.S. faced the possibility of default as early as June 1, the so-called X date, if a deal isn’t reached between the White House and Congress. On Tuesday, she doubled down on her warning to raise the limit immediately. Stocks dipped Tuesday as investors digested a lackluster forecast from Home Depot. Wall Street also turned its attention to a meeting between congressional leaders and President Joe Biden on the U.S. debt ceiling. The technique has proven to be very useful for finding positive surprises. As an investor, you want to buy stocks with the highest probability of success.

The company continuously invests in research and development to improve its products and services, which could give it a competitive advantage in the long run. Despite the potential risks and challenges, Samsara has several strategies to mitigate these factors. The company has a solid and experienced management team with a proven track record of success, which helps to instill investor confidence. Additionally, the company has a diversified product and service offering, reducing its dependence on any market or customer.

Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns. There are several options for investors looking to diversify in AI.

Samsara Stock: Impressive Growth Trajectory But Limited Upside ….

Posted: Wed, 26 Apr 2023 07:00:00 GMT [source]

Samsara has had a good financial position, which should sustain it through any short-term challenges. In 2022 the company reported cash on hand changing from positive $510 million to negative $710 million, a one-year difference of $1.2 billion. This lack of financial flexibility restricts the company’s ability to invest in growth opportunities or make strategic acquisitions. Samsara’s stock trades at a price-to-sales ratio much higher than industry peers. The price-to-earnings ratio is negative due to its current net loss. Samsara has experienced strong revenue growth in recent years, with revenues up yearly over the past several years.

Since then, IOT shares have increased by 58.2% and is now trading at $19.67. The looming U.S. debt-ceiling crisis has taken center stage in the U.S. financial markets as investors are holding out for an update on plans to resolve a three-month standoff and avoid a default on U.S. The company said to expect between $106.5 million and $107.5 million in revenue and between $39 million https://business-oppurtunities.com/the-road-to-ceo-psychological-strategies-for-career-success/ and $40 million in adjusted EBITDA for the first fiscal quarter. Both of those estimates were below consensus expectations, with analysts polled by FactSet anticipating revenue at $11.8 million and adjusted EBITDA at $45.4 million. In addition to tracking any updates on debt ceiling negotiations, investors will watch for data on housing starts and building permits on Wednesday.

By comparison, analysts polled by FactSet expected $1.96 per share and revenue to come in slightly lower at $1.38 billion. Morgan Stanley’s price target of $12 implies just 3.6% upside from where shares closed on Monday. Samsara issued an update on its first quarter 2024 earnings guidance on Thursday, March, 2nd. The company provided EPS guidance of -$0.06–$0.05 for the period, compared to the consensus estimate of -$0.05. The company issued revenue guidance of $190.00 million-$192.00 million, compared to the consensus revenue estimate of $182.44 million.

Target traded more than 2% lower in the premarket after the retailer reported total revenue of $25.32 billion for the first quarter, which represented year-over-year growth of just 1%. To be sure, that revenue figure, along with the company’s earnings per share, exceeded analyst expectations. According to 9 analysts, the average rating for IOT stock is “Buy.” The 12-month stock price forecast is $22.78, which is an increase of 15.81% from the latest price. Samsara’s mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy. We are the pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT data to develop actionable business insights and improve their operations. In terms of growth opportunities, Samsara has several avenues for expansion.

A 0.8% decrease in gas station sales held back the total, as did a 3.3% decline at sporting goods, musical and book stores. Only two S&P 500 sectors out of 11 were trading in positive territory on Tuesday morning. Bank of America Analyst Ebrahim H. Poonawala resumed coverage on regional bank Western Alliance with a buy rating. “The failure of the Fed to acknowledge that monetary policy errors are the underlying cause of bank instability is very revealing,” Rep. Barr said. “The question, you know, in my mind is have we gotten to that rate yet? And at this point, given the data we’ve gotten so far, I would say no, I don’t think we’re at that rate yet,” she said. A nonvoting member on the rate-setting Federal Open Market Committee, Mester added that she’d like to see rates at a place where a cut or increase would be equally likely as the next move.

There are a variety of indicators forecasting the U.S. to enter a recession — but this market implied gauge has reached 99%. He says the five-plus months of Nasdaq 100 outperformance over the S&P 500 is about to reverse. “Once two additional higher closes are recorded, sell countdown 13 will be recorded,” DeMark says. Western Alliance shares have been on a recent upswing, up 17% over the past week – and posting a gain of 15% since this week has begun.

It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. Shares of Samsara Inc. surged toward their best day on record Friday after the maker of internet-of-things technologies topped expectations with its latest results and outlook, soothing macroeconomic … Mid-cap land has long been regarded as the ‘sweet spot’ for equity investors. Here are three mid-caps Wall Street sees as two-baggers over the next 12 months.

Samsara (NYSE:IOT) Stock Price Down 5.4% Following Insider Selling.

Posted: Sat, 29 Apr 2023 07:00:00 GMT [source]

Six months after Morgan Stanley pulled its rating on Carvana shares, the firm reinstated coverage of the stock with an equal-weight rating. Not even technology, health care and communications managed that over the same time period, Strategas’ Chris Verrone wrote in a Tuesday note. “A default would crack open the foundations upon which our financial system is built,” Yellen said Tuesday. “It is very conceivable that we’d see a number of financial markets break – with worldwide panic triggering margin calls, runs and fire sales.” Investors are anxiously awaiting progress on debt ceiling negotiations.

PitchBook’s non-financial metrics help you gauge a company’s traction and growth using web presence and social reach. PitchBook’s comparison feature gives you a side-by-side look at key metrics for similar companies. Personalize which data points you want to see and create visualizations instantly.

One potential challenge for Samsara is increased competition in the IoT solutions market. The company will need to continue investing in research and development to stay ahead of its competitors. Another potential risk is increased regulation related to data privacy and security.

A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. InvestorsObserver is giving Samsara Inc (IOT) an Analyst Rating Rank of 36, meaning IOT is ranked higher by analysts than 36% of stocks.

Information technology and communication services stocks outperformed in the broader index, up about 0.35% and 0.32%, respectively. The Federal Reserve’s aggressive interest rate hiking campaign helped cause the troubles in the mid-size regional banking industry, Rep. Andy Barr charged Tuesday. Energy and utilities stocks were the biggest laggards in the S&P 500 on Tuesday, with each sector down 2.5% and 1.9%, respectively. Elsewhere, Verrone pointed out that the cap-weighted Nikkei exchange has already topped 2021 highs, according to the note. Stocks declined Tuesday, with the Dow Jones Industrial Average closing below its 50-day average for the first time since March 30.

The average price target for IOT is $22.6 and analyst’s rate the stock as a Buy. The company reported 20 cents in earnings per share excluding items, above the 17 cents expected by analysts. Revenue also beat expectations at $111 million compared with a $110.1 million forecast. Adjusted EBITDA came in at $48.9 million, ahead of the $45.7 consensus estimate. For the current quarter, the company said to expected between $2 and $2.06 in earnings per share for the current quarter, while analysts forecasted $1.96. Keysight guided revenue for the quarter to come in between $1.37 billion and $1.39 billion, a range that contains Wall Street’s consensus estimate of $1.38 billion.

View analysts price targets for IOT or view top-rated stocks among Wall Street analysts. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.27% per year. These returns cover a period from January 1, 1988 through April 3, 2023. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month.

Aging populations are already denting the credit ratings of governments. The Dow ended the trading session below a key threshold on Tuesday. On a year-on-year basis however, non-oil domestic exports fell 9.8%, more than the economists’ expectations of 9.4%. “While McCarthy said a deal is possible by end of this week, the timeline may be by the end of next week ahead of the Memorial Day,” JPMorgan traders wrote.

Contents

Poziom ten oblicza się poprzez podzielenie swojego kapitału przez wymagany depozyt zabezpieczający, a następnie mnożąc przez 100%. CFD to produkt lewarowany, co oznacza, że potrzebujesz tylko części wartości transakcji dla takiej samej ekspozycji na rynku. Pamiętaj jednak, że im wyższy zysk, tym większe ryzyko poniesienia starty.

Jeśli nie nauczysz się umiejętnie zarządzać ryzykiem, poziom straty może przekroczyć Twój początkowy depozyt. Oznacza to, że jeśli rynek porusza się na Twoją korzyść, Twój zysk może być dużo wyższy niż w przypadku tradycyjnych Jak pobrać Forex Quotes Archive by para walutowa inwestycji w np. Przy otwieraniu pozycji, będziesz potrzebować określonej ilości dodatkowego kapitału nazywanego depozytem zabezpieczającym. Wypróbuj nasze konto treningowe i zacznij handlować w kilka minut.

Zwrot depozytu zabezpieczającego jest uzależniony od niektórych czynników, takich jak rodzaj rynku czy dźwignia finansowa na rachunku głównym. Na naszych platformach transakcyjnych znajdziesz wskaźnik zwany margin level. Gdy wskaźnik ten spadnie poniżej poziomu 50%, Twoja pozycja odnotowująca największą stratę zostanie automatycznie zamknięta. Jest to wbudowany mechanizm zabezpieczający Cię przed poniesieniem jeszcze większych strat.

Kontrakty CFD są złożonymi instrumentami i wiążą się z dużym ryzykiem szybkiej utraty środków pieniężnych z powodu dźwigni finansowej. 82% rachunków inwestorów detalicznych odnotowuje straty pieniężne w wyniku handlu kontraktami CFD u niniejszego dostawcy CFD. Zastanów się, czy rozumiesz, jak działają kontrakty CFD, i czy możesz pozwolić sobie na wysokie ryzyko utraty pieniędzy.

“Inni skończą się tu w 73 -letni biznes rodzinny. Jak prowadzi to w czasach współczesnychesach czekających ich kolei.” Tak naprawdę, jakiś biznes przy marginesach prawdopodobnie zostałby przegrany. “Co prezydent może robić jest marki jakieś zmiany w marginesach.” Kliknij poniżej by utworzyć konto poprzez naszą aplikację.

Możesz otworzyć znacznie większą pozycję niż w przypadku fizycznej transakcji. Depozyt zabezpieczający to inaczej wymagany depozyt do utrzymania każdej otwartej pozycji na koncie. Depozyt zabezpieczający nie jest kosztem transakcji, a pewnym zamrożonym kapitałem na czas otwarcia pozycji, zwracanym na konto wraz z zamknięciem pozycji. To z kolei oznacza, że zwroty Twoich inwestycji są znacznie większe w porównaniu do początkowej kwoty depozytu. Inwestowanie z dźwignią umożliwia Ci obracanie bardzo dużym kapitałem i, przy stosunkowo niewielkim zaangażowaniu własnego kapitału. Jakikolwiek margines mniej niż na 156 punktów mogą składać się w jednym wyścigu.

Podejmując decyzje inwestycyjne, powinieneś kierować się własnym osądem. Więcej informacji dostępnych jest w Deklaracji Świadomości Ryzyka Inwestycyjnego, dostępnej na stronie internetowej Wolne środki stanowi kapitał, który masz do wykorzystania na otwieranie nowych transakcji lub pokrycie ewentualnych negatywnych ruchów rynku na otwartych już pozycjach.

Inwestując na Forex i w kontrakty CFD, wymagany jest odpowiednio wysoki depozyt, aby w ogóle móc otworzyć pozycję. Ważne jest, aby Co dzieje się dalej po Wielkiej Brytanii PM Johnson pisze Brexit list opóźniony wiedzieć, że depozyt zabezpieczający to nie jest koszt transakcji. Cała kwota wraca na Twoje konto wraz z zamknięciem pozycji.

Te mówić przez 2 – aby-1 margines, który on powinien przebiegać dla Prezydenta w 1992. Żaden wcześniejszy prezydent nie wygrał tak duży margines. Tym razem, znaleźli się w dół jeszcze raz przez duży margines. Tym razem, margines wystarczył dla obrony by przejąć obowiązki. Gra zostałaby blisko od tego czasu, z nigdy więcej niż sześć margines punktu przez którykolwiek zespół. W takim razie przesunął się w kierunku imienia, które było margines.

Contents:

For the newbies, you get quick access to 26 different cryptocurrencies on an easy-to-use platform. Veteran crypto-traders can take advantage of more advanced features and sophisticated trading tools. NDAX offers something for everyone, making it one of the best crypto exchange platforms in Canada. NDAX has one of the lowest trading fees/commissions among the Canada-based cryptocurrency trading platforms I have reviewed. It also has fast processing times for deposits and withdrawals. Regulators have completed a review of some of the filings and are currently reviewing the remainder of the filings received.

This fixed fee will ensure you know exactly what you will be paying in fees per trade. There are no deposit fees and there is a fixed $4.99 bank withdrawal fee. These fixed fees are an incentive to trade larger amounts, which is a clever tactic. The rigorous KYC is somewhat of a deterrent, but once cleared, trading, depositing, withdrawing, and closing the account was easy enough.

However, your payout will be marked as pending at this time. NDAX claims to have USD 3 million in insurance per instance on its hot wallets and keeps USD 5 million on its cold wallets, which covers internal theft and Hardware Security Module (HSM) malfunction. They also have CAD 5 million in general business liability.

The tier you fall into is based on how many users join the platform using your NDAX affiliate link on a monthly rolling average basis. Canadians looking to trade the Canadian dollar fiat for crypto can access the marketplace using platforms such as NDAX, CoinSmart, Bitbuy, and Wealthsimple Crypto. Cryptocurrencies have grown in popularity in recent years. While they remain a highly speculative asset, the unbelievable price increases exhibited by Bitcoin and several altcoins have led many retail and institutional investors to jump in despite the risks. If you want to withdraw or send above $2500 their fee is always only $25 (solid money). If you buy small amount of crypto for fun or curious , don’t use Ndax use another platform.

Providing your SIN is optional, but it definitely weirded me out a little bit. I had a pleasurable experience purchasing crypto on the NDAX mobile app – from setting up the account, to funding and purchasing crypto. The platform offers a reasonable crypto selection which I hope to see expand in the future and further improve their staking offerings and enable mobile support. Visit the Canadian Securities Administrators’ website for a list of crypto asset trading platform decisions in other jurisdictions. NDAX claims that its trading platform is designed for newbies and experienced traders alike.

Registered as a Money Service Business with FINTRAC and AMF, NDAX is fully compliant with Canadian regulations. Being compliant is important when choosing a cryptocurrency exchange because otherwise, it could be a scam. Compare dozens of Canadian crypto exchange platforms and find the one that best suits your needs. Or, we could place a new order that isn’t at market price, and buy at a lower price where it is good until filled or canceled. As mentioned, there are plenty of order options, including Market, Limit, Stop, and Stop Limit, where you can set the limit price. To open your account, you must fill out information including your first and last name, date of birth, and proof of identification using a driver’s license.

Investors must be knowledgeable when it comes to the various currencies on the market and the risks involved—not only volatility but also matters of utility, usage and liquidity. Could Ethereum best meet your enterprises investment goals? It’s even more important to choose your trading desk wisely, based on factors such as security, cost, speed and https://forex-review.net/ transparency. NDAX also welcomes new voices who wish to promote and review their platform. Furthermore, if you’re seeking sponsorships outside of its affiliate program, you can simply send an email to [email protected] with as much information as possible. When you join NDAX, you’ll be given a unique referral link to share with your friends.

At that point we can withdraw the $50 in funds since we have all the verification and security positions met, either through a bank wire or convert it back to BTC or another coin and hold. One of the first things you will have to do once you have registered and logged in is to complete the identification verification step. This involves completing the necessary information that is required in order to open an account with NDAX. It’s is totally normal for regulated cryptocurrency exchanges and shouldn’t be cause for alarm. It’s called Know Your Customer (KYC) information and is required in order for them to be compliant with Canadian financial regulations. However, NDAX is the first exchange I’ve used that asked for my Social Insurance Number (SIN).

Catch-up with the mainstream and take the next step in building your businesses crypto portfolio. Through strong Treasury management, you can safely and knowledgably invest in cryptocurrencies. However, note that there is a cap of $1000 MAXIMUM commission earnings per referral for 1 year. The NDAX Wealth Over-The-Counter (OTC) services are one of the most reliable liquidity pools in North America. BBB Business Profiles generally cover a three-year reporting period. If you choose to do business with this business, please let the business know that you contacted BBB for a BBB Business Profile.

Got verified within a few minutes of uploading the required documents. I never keep my Bitcoins in the exchange (got burned for 3.5 BTC in the MtGox fiasco). The $25 fee for withdrawals (any withdrawal) is pretty steep for a small test transaction but it was worth the entire process.

NDAX cryptocurrency withdrawals are processed instantly and sent to the blockchain. The time it takes to reach your wallet depends on network congestion. After combing through numerous genuine NDAX user reviews, the takeaway is that the NDAX customer service could use some work.

MoneySense is not responsible for content on external sites that we may link to in articles. MoneySense aims to be transparent when we receive compensation for advertisements and links on our site (read our full advertising disclosure for more details). The content provided on our site is for information only; it is not meant to be relied on or used in lieu of advice from a professional.

We like its highly-rated app, the fixed fee, its educational content on every coin it lists. It was confusing and I was surprised they asked for the employment information. However, it’s FINTRAC regulation thing and all reliable Canadian crypto exchanges need to ask these questions. There is a page about each cryptocurrency they offer with the coin’s history, use ndax review cases, charting, how to buy crypto, and more. This educational content is a huge welcome because it shows a level of thought and care for their customers to make informed decisions, which is not seen by all exchanges. NDAX has also implemented a Distributed Denial-of-Service-Protection (DDoS) that protects the platform against hacks and other malicious attacks.

They got back to us a very impressive 20 minutes later to let us know that they only have email support. NDAX is a cryptocurrency exchange for Canadians based in Calgary. We signed up for an account to see if it’s worth using in 2023.

Get access to multiple fiat currencies and advanced trading tools. People who write reviews have ownership to edit or delete them at any time, and they’ll be displayed as long as an account is active. At OCryptoCanada, we like to give people knowledge to become aware and catch up in the cryptocurrency industry. Cryptocurrency will be one of the main medium exchanges in the future.

Then, you’ll need to provide images of your government-issued ID and a selfie. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Use this form to submit website feedback and suggestions, or to inform us about website issues.

For the crypto whales and institutional investors, you can use their Over The Counter (OTC) service for crypto purchases of $200,000 or more. Speak with an NDAX expert for a seamless execution for all your high-volume trades. Simply fill out a form to connect with an account manager. You’ll get access to fast transactions, a deep liquidity pool, and no slippage. The charting options for each of the currencies on the platform are quite amazing, offering users the chance to dial in on specific elements of a trading period, short ranges, long-term, or other options. The buy orders are in a blue-green color, and the sell orders are in red, indicating the buying and selling over a specific period of time.

Finally, the last Canadian company you should look into is Coinsmart, a cryptocurrency trading and investment platform founded in 2018. The site offers various sought-after features like cryptocurrency wallets, referral programs, low or no-fee transactions, and over 15 crypto coins for trading. Other exchanges may advertise free trades, but they nail you on the spread. Every platform makes money on your trades, some just hide the fee in the spread.

Contents

The most popular ShibRWD trading pairs are Head to the Crypto Deal Directory to access custom & exclusive discounts, vouchers and welcome bonuses from the most popular exchanges. The quantity of all coins/tokens that have ever been issued , minus all coins/tokens that have been removed from circulation . The Total Supply is similar to stock market’s Outstanding Shares.

The https://coinbreakingnews.info/ price page is just one in Crypto.com Price Index that features price history, price ticker, market cap, and live charts for the top cryptocurrencies. Adding ShibRWD to MetaMask allows you to view your token holdings, trade on decentralized exchanges, and more. You can copy SRWD’s contract address and import it manually, or if you’ve installed MetaMask’s chrome extension, add SRWD to MetaMask with one click on CoinGecko. SRWD tokens have stopped trading 15 days ago on all exchanges listed on CoinGecko. Information will be updated if market activity resumes. Buying ShibRWD for funds from your bank requires a 2-step process.

A list of the top ShibRWD markets across all crypto exchanges based on the highest 24h trading volume, with their current price. We also gather additional information from different sources to make sure we cover all necessary data or events. As the incorporation of reflections is the new trend in tokenmics of crypto assets being launched, we at $SRWD have begun a new trend. We have created a token that generates rewards in the form of reflections in one of the most influential cryptocurrencies created $SHIB! Through the execution of a 12% tax on every transaction, purchase or sale, the community of diamond-handed holders is rewarded with 4% reflections in $SHIB. The top crypto exchanges that have ShibRWD available for trading, ranked by 24h trading volume and the current price.

To check 10 best vpns for torrenting: top for speed + privacy‘s price live in the fiat currency of your choice, you can use Crypto.com’s converter feature in the top-right corner of this page. You will receive an email with instructions for how to confirm your email address in a few minutes. Layer 2 protocols are a set of off-chain solutions running on top of Layer 1 blockchains to compact the bottlenecks of scaling and transaction costs. Increase from one day ago and signalling a recent rise in market activity.

Coinmomo.com needs to review the security of your connection before proceeding. Circulating supply shows the number of coins or tokens that have been issued so far. Popularity is based on the relative market cap of assets. This calculation shows how much cryptocurrency can cost if we assume that their capitalization will behave like the capitalization of some Internet companies or technological niches. If you extrapolate the data, you can get a potential picture of the future price for 2022, 2023, 2024, 2025, 2026, and 2027. The simple answer is “yes”, and you can buy less than 1 ShibRWD.

For the last 30 days, more than 8 SRWD transactions have been made, on average daily 0.27 completed transactions. HowTo Guides How to buy / sell / send Crypto guides.Crypto Questions Answering most of your crypto questions. Fundamental Analysis Key factors and information to perform crypto fundamental analysis. Security-First Multi-Asset SegWit-Enabled Wallet for Bitcoin, Altcoins and Tokens. There are guides to manage an unofficially supported ERC-20 token on Ledger and Trezor.

Here is it as well as other useful data about this kind of cryptocurrency. At TheBitTimes.Com, we collect and provide any valuable content on it such as 1 SRWD to USD so that you could make a favorable investment and have a positive result. ShibRWD has created a token which generates dividends in the form of reflections in the Shiba Inu Token. Through the execution of a 12% tax on every transaction, purchase, sale and transfers, the $SRWD holders are rewarded with 4% reflections in $SHIB..

The other Co-Founder is Mr. Amir Shoolestani , founder of a successful social media influencer marketing company with a Masters in Engineering. Transfer your newly purchased BTC or ETH from your wallet to one of the exchanges listed below. FDMC is the Market Cap if the Maximum Supply of a coin/token was entirely in circulation. Most Secure Wallets To Start With Check the analysis report on Top-rated Crypto Wallets that are safest for your funds. Exclusive Crypto Deal List of 2022 Get huge savings on the biggest crypto brands with custom discounts & deals.

There is no recent price data for this coin, because we don’t see trading activity currently. According to an in-depth review process and testing, Ledger and Trezor are one of the safest and most popular hardware wallet options for keeping ShibRWD. For exclusive discounts and promotions on best crypto wallets, visit Crypto Deal Directory. SRWD has a trading volume of $0 in the last 24 hours. These are the project’s quantitative metrics of its Organizational GitHub Public account that can be used to trace regular or artificial development activity & growth within the project.

Binance is not responsible for the reliability and accuracy of such third-party sites and their contents. The total dollar value of all transactions for this asset over the past 24 hours. ShibRWD is a blockchain asset with high risk, please be sure to carefully study the crypto info before investing. View the total and circulating supply of ShibRWD, including details on how the supplies are calculated.

Connecting wallet for read function is optional, useful if you want to call certain functions or simply use your wallet’s node. Follow me, I will show you the learning path, as well as how to earn big rewards while learning. Unfortunately, seems like there is no data available for ShibRWD because of coin inactivity. Gain XP & Collect Rewards Gain your Crypto XP by learning crypto & redeem your rewards later. If you are planning to trade crypto, please consult a financial adviser. ShibRWD is on the Ethereum network (ERC-20) so it can be stored using any ETH compatible wallet.

The current cryptocurrency Market Capitalization Dominance among all other cryptocurrencies in the market. Market Capitalization is the overall value of all coins/tokens that have been mined or issued until now and are in circulation . It’s similar to the stock markets’ Free-Float Capitalization. The cryptocurrency’s market Price changes in percent within the last 24 hours . After the start of the token on Dec 14, 2021, on the Ethereum platform, more than 421 wallets owned/owns SRWD also 2,266 successful token transactions have been recorded till today.

We have a team of Seasoned Developers as well as an incomparable Marketing team. This Token was generated to ease the mind of investors when holding a crypto. With the purpose of bringing legitimate investments into the crypto space. Bitcoin, Ethereum and Altcoins hardware wallet, based on robust safety features for storing cryptographic assets and securing digital payments. You can store coins on exchanges after purchase but we recommend using a dedicated wallet for security and long term storage. Hardware wallets offer the most security but cost money.

New Cryptocurrency Newest crypto coins and tokens added to CoinCheckup.Popular Cryptocurrencies Trending crypto tokens and coins on CoinCheckup. The most active and popular exchanges for buying or selling SRWD are Binance, Kucoin & Kraken. Find more crypto exchange options on our Crypto Exchange Tracker. The most secure hardware wallets for keeping your cryptocurrency safe are Ledger and Trezor.

They have the requisite experience and track record to develop, launch and promote successful crypto-related projects. If Binance is not available in your jurisdiction, view our list of exchanges that sell ETH for Government issued money. Please also note that data relating to the above-mentioned cryptocurrency presented here are based on third party sources. They are presented to you on an “as is” basis and for informational purposes only, without representation or warranty of any kind. Links provided to third-party sites are also not under Binance’s control.

CoinGecko provides a fundamental analysis of the crypto market. In addition to tracking price, volume and market capitalisation, CoinGecko tracks community growth, open-source code development, major events and on-chain metrics. BitDegree Crypto Learning Hub aims to uncover, simplify & share cryptocurrency education with the masses.

All-in-one app to secure, manage and exchange blockchain assets. The team’s projection is to achieve at least 100,000 token holders in the shortest possible time. Track over 10,000 crypto prices in real-time with ease. ShibRWD’s current circulating supply is 7.00T SRWD out of max supply of 600.00T SRWD. ShibRWD is a decentralized financial payment network that rebuilds the traditional payment stack on the blockchain.

ShibRWD cryptocurrency is marked as ‘Untracked’ because of inactivity or insufficient amount of data. Dec 14, 2021, was the day when a smart contract for token was started on the Ethereum platform, approximately 1 year ago, for today there are more than 421 token addresses that own token. Showing how wealth is distributed between all holders, for example, the top 10 richest addresses hold 94.82% of all available supply. Investment Analysis Historical performance and stats for all cryptocurrencies.GitHub Analysis Development activity on Github for open source cryptocurrencies. ExchangeBuy/Sell withPriceVolume Maker FeeTaker FeeUpdatedWe do not have exchanges listed for this coin yet. Try visiting the project’s website for more details.

It utilizes a basket of fiat-pegged stablecoins, algorithmically stabilized by its reserve currency SRWD, to facilitate programmable payments and open financial infrastructure development. As of December 2020, the network has transacted an estimated $299 billion for over 2 million users. The team behind the success of ShibRWD is not anonymous. The team members are fully doxed and KYC Verification.

The content published on this website is not aimed to give any kind of financial, investment, trading, or any other form of advice. BitDegree.org does not endorse or suggest you to buy, sell or hold any kind of cryptocurrency. Before making financial investment decisions, do consult your financial advisor. These are the project’s quantitative metrics of its official Reddit account that can be used to trace regular or artificial Social activity & growth within the project. These are the project’s quantitative metrics of its official Twitter account that can be used to trace regular or artificial Social activity & growth within the project. These are the project’s quantitative metrics of its official Telegram account that can be used to trace regular or artificial Social activity & growth within the project.

Contents:

Revenue per average customer/average sales transaction– Similar to average weekly sales, the average sales transaction refers to the average revenue per transaction. High average sales transactions can imply that the customer footfalls aren’t huge, but customers spend a lot more per transaction on average. This is generally true for high-end luxury restaurants.

Other concerns – Many barriers to entry and their effect on market competition like fast food chains enter into agreements that compel them to fulfill certain obligations, such as opening a certain number of outlets and/or franchises within a stipulated time. Contractual obligations of such a face may make the stock price volatile as they may constrain the company to take actions, which might not be in the best interest of its shareholders. Average weekly sales– Average weekly sales, also called average weekly net sales , refers to the average revenue a company generates in an operating week.

No, CNNE shares are not listed on NSE or BSE. Cannae Holdings, Inc. is listed on the NASDAQ stock exchange. The lowest CNNE stock price was $ 17.11 on 10th Apr 2023 within the past 52 weeks. Take your analysis to the next level with our full suite of features, known and used by millions throughout the trading world. Cannae Holdings, Inc. reported Q3 EPS of $0.69, $0.70 better than the analyst estimate of ($0.01). Revenue for the quarter came in at $164.5 million versus the consensus estimate of…

Store Additions – As mentioned above, restaurants grow their revenues by opening new stores. So, it’s vitally important to track their pace of new store additions as well. Generally, an increase in the number of stores/outlets indicates growth and is a positive sign for the company and its investors, since this increases future revenue potential for the company. It also signifies the company’s management and its board’s confidence in the restaurant chain and how it’s being operated.

Revenue per employee generally indicates the efficiency of the company. The restaurant industry is one of the fastest-growing industries currently. As time is progressing, more people are eating out and contributing to this. Many companies like Chipotle Mexican Grill have announced that a significant number of restaurants that it opens this year will have drive-thru facilities. Since the pandemic is not going anywhere anytime soon, restaurants are adapting themselves to the new normal. Such drive-through and takeaway options will also encourage those people to eat out who would otherwise not prefer dining inside a restaurant.

Yes, you can buy fractional shares of Cannae Holdings, Inc. with Scripbox. Today, on 10th Apr 2023, the price of Cannae Holdings, Inc.

I aspire to be a top-tier portfolio manager in the future. Another trend observed in this sector is the growing use of technology and innovation in and outside the kitchen. Companies like Starbucks doubled their unique customers within 2 years of their app launch. Online ordering has increased over the years. With the consequences related to the Covid-19 pandemic, this rate has increased rapidly. There is greater demand for home-delivered food, and people are switching from in-restaurant dining at an increasing pace.

https://1investing.in/ Holdings Inc share price live 19.01, this page displays NYSE CNNE stock exchange data. View the CNNE premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Cannae Holdings Inc real time stock price chart below. You can find more details by visiting the additional pages to view historical data, charts, latest news, analysis or visit the forum to view opinions on the CNNE quote. Business Quant is a comprehensive investment research platform that hosts most of the aforementioned data points.

The book value of a stock is theoretically the amount of money that would be paid to shareholders if the company was liquidated and paid off all of its liabilities. Other obligations– Companies often enter into contracts and agreements which may force them to operate in a certain way, that might not be desirable in the short run. Such contractual agreements must be kept in mind before you decide to invest in a company. World-class wealth management using science, data and technology, leveraged by our experience, and human touch.

People have also started to choose health over taste. There is a rising demand for healthy and organic food options and unhealthy processed foods are losing widespread appeal. People also prefer restaurants that are eco-friendly as they consider it a step towards a healthier environment. Mutual Fund investments are subject to market risks.

An increase in the franchisees of the company may indicate that people and investors deem it profitable, successful and investable, hence more people are willing to run a business under the brand name. Franchise fees and royalties are a stable source of income for the restaurant chain, with minimal operating costs or capital expenditures involved. Comparable sales – Restaurants chains grow revenue by opening new stores and by expanding sales of their existing stores. The comparable sales figure tracks the latter — it encompasses sales from stores that already existed a year ago and doesn’t include the revenue contribution from new stores.

This item is an excellent and simple basis of comparison between companies in this industry. Higher AWS signifies increased sales volume and customer footfalls. Revenue – The revenue figure in the restaurant industry is slightly different from the aforementioned system sales. A restaurant chain’s revenue is the aggregate franchising fee that it earned from its franchises, in addition to the revenue that it earned from from its own company-owned stores. In this calculation, we leave out the revenue earned by its franchises.

Please read all scheme related documents carefully before investing. Past performance is not an indicator of future returns. Cannae Holdings, Inc. shares has a market capitalization of $ 1.466 B.

In the early stages of a startup restaurant chain, it may be difficult to decipher and predict whether the concerned company would close shop in a few years or would go on to become a successful story. Table turnover rate– Table turnover rate or table turn rate, is the average number of parties served per table. A higher turn rate can imply that the restaurant is serving more customers per table, hence maximizing its revenue per table. For companies with tight margins, the table turn rate should be more. It is calculated by dividing the number of groups served by the total number of tables.

So, there’s a term called “system sales” which refers to the combined sales across all the operating outlets, be it company-owned or franchised stores. Tracking system sales helps in understanding how the entire restaurant chain is performing as a whole. If system sales are suffering, then it raises doubts on whether the brand is losing its relevance or competitive positioning in the market.

Difficulty in Profitability – Restaurants business is capital intensive in nature. From pre-opening costs down to their day-to-day activities, there are various kinds of capital expenditures and depreciation expenses involves. All these expenses can quickly rack up and weigh on their margins. Many newcomers and restaurant startups are unable to sustain the cost margin model in this industry and companies, generally, have to remain operational to break even and take advantage of unit economics. 99% of companies are not listed– The majority of the restaurants in this industry are not listed on the exchange. A major portion of the restaurant sector is owned by private companies or individuals, which makes it less regulated compared to other sectors like oil and gas.

Compass Diversified’s (NYSE:CODI) latest 3.3% decline adds to one-year losses, institutional investors may consider drastic measures.

Posted: Sun, 05 Mar 2023 08:00:00 GMT [source]

Tracking this sector is also difficult because of this reason. Revenue per available seat hour– As the name suggests, it refers to the revenue as a multiple of the available seat hours. A restaurant may maximize its table turnover by opening for longer working hours. This metric normalizes this practice and provides an accurate picture of revenue per working hour. Enterprise Value is a measure of a company’s total value, often used as a more comprehensive alternative to equity market capitalization.

This reflects an accurate picture of the restaurant chain, since newly opened outlet generally aren’t profitable and lack the customer footfall in the initial days of operation. Also, comparable sales growth shows how much the company’s revenue from its existing store network is growing. System sales– Restaurant companies have a few different operating structures. These include having company-owned stores, franchised stores or a mix of both.

Содержание:

Суть данного индикатора заключается в том, что он отображает фазы движения цены (вóлны) в виде направленных промежутков. Таким образом, каждую волну можно определить как импульс (движение вперед) или коррекцию (откат). Например, если на рынке наблюдается флэт или импульсивное неупорядоченное движение в разные стороны, волн не будет, поэтому использовать алгоритм в этом случае не получится.

Более того, нет точных рамок начала и завершения этих самых волн. Иными словами, если мы знаем, что в “бычьей” фазе первая, третья и пятая волна развиваются в восходящем направлении, то это говорит о том, что в эти периоды необходимо совершать покупки. Во время развития второй и четвертой волн в таком случае необходимо заниматься продажами. Соответственно, задача трейдера-аналитика будет сводиться к тому, чтобы определить момент завершения медвежьей фазы предыдущего цикла и начала первой волны нового бычьего периода. Первая волна Элиота – одна из самых трудных для наблюдения, потому что именно с этой волны начинается весь цикл. Эта волна может быть более заметна трейдерам, знакомым с фундаментальным анализом, в то время как у любителей технического анализа могут возникнуть проблемы с прорисовкой первой волны из-за использования других индикаторов.

Чтобы правильно прочитать график, нужно тщательно изучить соответствующую теорию. Волны Эллиота – способ анализа, представленный на графике, позволяющий оценивать поведение активов на фондовой бирже, на основании движения цен. После разворота и образовании волны Эллиотта b, цена двигалась в восходящем тренде, достигла точки разворота 0.5.

Волновая теория Эллиотта изначально основана на следующих правилах подсчёта волн и их сравнении с другими волнами с учётом уровней коррекции и расширений Фибоначчи. Волновой принцип или волновая теория Эллиотта основаны на совершенно ином подходе к стандартным концепциям технического анализа. Такой инструмент поможет наглядно изобразить волны Эллиота и отслеживать переходы из одной фигуры в другую. Многие источники рекомендуют совместить такую разметку с линиями Фибоначчи. Растягивая сетку в границах волн, можно точнее определить их длину, глубину коррекции и, соответственно, точку входа. Любого трейдера интересует прикладное значение каждого инструмента технического анализа.

А из простых, на мой взгляд, плоская коррекция все же встречается чаще. Однако, отдавая дань уважения истории развития волновой теории старика Эллиота, отметим относительную частоту появления зигзагов. Она является самой большой из трех импульсных волн, ее длина должна составлять как минимум 161,8% от второй по величине импульсной волны, скорее всего, это будет 3-я волна. 5-я волна в этом случае, как правило, выглядит неудавшейся и не достигает линии, проведённой через конечные точки волн 1 и 3. Учитывая правило чередования, самой сложной волной из коррекционных волн 2 и 4 будет 2-я волна.

Пьер Кюри в начале нашего столетия сформулировал ряд глубоких идей симметрии. Он утверждал, что нельзя рассматривать симметрию какого-либо тела, не учитывая симметрию окружающей среды. Этот вывод приобретает особое значение для Analystov финансового рынка.

Для нахождения оптимальных точек входа в рынок, необходимо дождаться появления на графике одной из коррекционных формаций. Переход на уровень ниже предполагает поиск пиковых точек между концом волны B и началом волны C во второй и четвертой коррекционной волне для размещения ордеров Buy Stop над ними. Также этот переход предполагает поиск фрактального https://prostoforex.com/ пика подволны 1 для волн 3 и 5 более высокого порядка. Подобную тактику можно применять и при поиске точек для продаж в волне C после пробоя минимума подволны B внутри волны B и после пробоя окончания подволны 1 в импульсной волне C. Для совершения покупок достаточно над пиками первой и третьей волны разместить отложенные ордера Buy Stop.

2 – данный участок графика имеет направление противоположное общей тенденции, учитывая, что на нем могла пропасть только одна волна, будет достаточно определить его СО, считая его моноволной. Если после определения СО соседних волн не удастся построить стандартную структурную серию, то необходимо будет провести подробно исследование данного участка на меньшем временном интервале. Если стандартную структурную серию составить все же удастся, то пропажу волны на данном участке графика можно просто игнорировать.

Рассматривая методику определения внутренней структуры моноволны и применяя соответствующие правила, Вы должны были обратить внимание на большой объем механической работы. В принципе ее можно было бы поручить компьютеру, если написать соответствующую компьютерную программу. Эта программа могла бы выгодно отличаться от уже трейдинг и инвестирование для профессионалов существующих программ по волновому анализу, т.к. Выполняла бы исключительно механическую работу, присваивая структурные обозначения каждой моноволне и не пытаясь провести абстрактную оценку развития событий на рынке. По причине отсутствия у машины абстрактного мышления переложить эту работу на компьютер невозможно.

И этот рассказ имеет довольно убедительное значение, поскольку Волновая Теория Элиота предоставляет кажущуюся возможность приспособить какой-либо сегмент истории развития финансового рынка к флуктуациям в данный момент времени». Темой книги является прикладной аспект теории Эллиотта, одной из наиболее завершенных в настоящее время концепций технического анализа и поведения финансовых и товарных рынков. Автору удалось перевести теоретические положения волнового принципа в практические приемы трейдинга. Особый акцент делается на алгоритмы диагностики и прогнозирования поведения рынка, прошедшие испытания на практике. Работа этого индикатора заключается в выявлении волн при помощи отрисовки пиков. Для того, чтобы правильно пользоваться данным индикатором, необходимо хорошо ориентироваться в теории волн.

В графике допускаются небольшие погрешности, поскольку он является всего лишь анализом, но построение не должно иметь существенных недочетов и отклонений. На этом можно сказать что восьми волновой цикл Эллиота закончен, но не всегда , не забывайте что пятая волна может быть растянутой. Торгуя в пятой волне, открываем лонг на откатах, пока цена не достигнет намеченных точек разворота. Это означает, что вы при торговле по волнам Эллиотта обязательно столкнётесь с убытками. Торговля на основе волн Эллиотта в какой-то момент привлекает внимание многих трейдеров.

Как раз этого нисходящего участка и не хватало для завершения модели; сразу после ее завершения, несмотря на положительный новостной фон, произошел разворот рынка, и началось существенное и достаточно долгое падение доллара. С точки зрения Волновой теории в тот момент времени это была достаточно предсказуемая реакция, хотя столь прозрачной она бывает не всегда. Особенно это актуально при развитии сложных коррекционных моделей, которые подробно описаны в разделе «Особенности формирования сложных волновых структур».

Поэтому, если пять волн могут быть идентифицированы в волне “а”, ожидайте материализацию рынка в виде зигзагообразной формации. Анализа позволяет вовремя определить завершение ценового движения, а также предугадать, куда пойдет в дальнейшем цена актива. Вместе с тем, если трейдеру кажется, что система выполнила неверное построение, он всегда сможет самостоятельно задать их. Тогда как три волны, стремящихся против тренда, представлены в качестве A, B, C. Одноименная теория способна математически объяснить с точки зрения психологии, модели поведения толпы. В настоящее время, эта теория используется как часть индикатора Elliott Wave для торговых платформ, таких как MetaTrader 4 и 5.

Если же участок между «вершиной» и «дном» совпадает с волной, направленной вниз, и при этом индикатор лежит, главным образом, ниже нулевой линии, то, вероятнее всего, этот участок совпадает с корректирующей нисходящей волной. Импульсная фаза волнового цикла состоит из пяти волн, корректирующая фаза — из трех. Благодаря волновому осциллятору Эллиотта трейдер имеет возможность увидеть, где заканчивается одна волна и начинается другая.

Важно понимать что цена не обязательно доходит до предполагаемой точки разворота, необходимо следить за индикаторами и использовать правило ретеста. Так же не будет лишним выучить все возможные формации которые могут появится на каждой из волн. После того как цена достигла уровня 1.618, необходимо закрыть длинную позицию. Стоит понять точно ли это конец третьей волны, или же промежуточная остановка. Это может быть концом второй волны либо просто уходом рынка в боковик, наблюдаем дальше. На рынке образовалась формация двойная вершина , осцилляторы идут вниз это является одним из признаком конца первой волны.

Хотя, справедливости ради, нужно заметить, что это возможно только при достаточном ценовом и временном масштабах фигуры. Грамотное применение волновой теории позволяет использовать в целях извлечения спекулятивной прибыли не только сужающиеся треугольники, но даже такую сложную и нестабильную фигуру, как расширяющийся треугольник. Видя перед собой эту схему, легко предположить, как цена будет развиваться далее. Эти волны должны отвечать некоторым требованиям, описанным в Главе 2 настоящего методического пособия.

Он воспроизводится как осциллятор, который программируется на большинстве программно-аппаратных средств, предоставляющих информацию о котировках. Скользящее 5-периодное среднее сглаживает и представляет текущую, краткосрочную силу рынка, а 35-периодное скользящее показывает силу рынка за более длительный период. Например, представьте, что вы в настоящее время находитесь в волне 3. Скользящее среднее с 5-периодами представляет собой коэффициент движения цены внутри волны 3. Это скорость изменения цены, также как и MFI развивается быстрее, чем в любое другое время в отсчете волны Эллиота. Скользящее среднее с 34-периодами представляет скорость движения цены, или MFI, внутри волн 1 и 2.

У Вас должна быть установлена платформа MetaTrader 4, чтобы начать использовать ВЭ. Если у Вас ее нет, откройте Демо счет, чтобы получить доступ к счету с виртуальными деньгами. После того как Вы скачали и установили MetaTrader 4, вы должны войти в платформу.

The pointed tip has a similar shape to a needle, which will enable it to get into tight spaces. Acing every test with a perfect score, this tweezer grips and pulls hair quickly and painlessly — though the end is sharp, so be mindful when plucking. Considering how effective and affordable this sleek tweezer is, we think it’s a great pair to add to your grooming kit. You shouldn’t have to spend more than a few seconds trying to pluck a stubborn eyebrow hair, and with the Tweezerman Micro Mini Slant Tweezers Trio, you won’t have to put in any extra effort. Earning a perfect score in all of our tests, this set of three tweezers was a favorite with our team for its design and how well each tweezer gripped and removed hair.

We love the durable yet lightweight design — perfect for sitting in front of your mirror for a long tweezing session without your hand cramping up. Our team loved the versatile design of this pair of tweezers — which doubles as an eyebrow brush. This combo is ideal for sweeping back various sections of the brow to see any tiny stray hairs lurking underneath. The flat wide tip might not be as precise as other tweezers, but it makes it easy to grip larger sections of hair (say two or three longer pieces). While the sizes are rather small, they make this set perfect for travel — not to mention the rose gold case that’s easy to spot in your makeup bag. We found the tweezers easy to use and maneuver around the brow, and we appreciated the various points and tips on each one.

Tweezers are a handy tool to have with you when you’re on the go, but before using them on your skin, you should consider whether or not they are the best option for you. Modern tweezers come in a variety of types and can be classified based on different criteria such as usage, materials, and functionality. Cross-locking tweezers (aka reverse-action tweezers or self-closing tweezers) work in the opposite way to normal tweezers. Cross-locking tweezers open when squeezed and close when released, gripping the item without any exertion of the user’s fingers.

The tweezer tip is made of metal and has a minimal surface area, making it easier for the user to grab onto the hair and pull it out without damaging their skin. It removes those pesky hairs that bother you and leaves your skin smoother than ever. There is no definite conclusion to this debate – but we can break it down for you. The point on the tweezers is used to guide hair you are removing from its follicle, but why is it there?

In addition, they remove ingrown hairs when they become infected safely. Point-tip tweezers are the perfect tool for everyone with fine hair, thin or nonexistent eyebrows, or minimal facial hair. This pair of tweezers is ideal for those who get tiny hard-to-pluck hairs around the edges of their brows. The tweezer itself is quite small (which might be tricky for those with larger hands), but it snatches baby eyebrow making sense of bitcoin and blockchain hairs with ease.

But the market is flooded with an array of options– from slant-tipped tweezers, needle 1000 gbp to pln exchange rate nose tweezers, and even flat-tip tweezers. Flat-tip tweezers are a versatile tool that lends itself well to various tasks. They can greatly remove splinters or ingrown hairs that just won’t come out with regular round tweezers. For example, some people use them for cosmetic purposes such as removing unwanted hair on the face or body, removing makeup, and smoothing eyebrows.

The tweezer feels strong and durable when holding it, and it can be used lightly and still get quite a few hairs with each pluck. This pair of tweezers is ideal for the section between your brows and on the end above the tail of your brow where the skin is less sensitive. If you need to remove ingrown hairs we recommend the Majestic Bombay tweezer, whose sharp tip is precise enough to free small objects from the skin.

If you get a good pair of tweezers that meets your needs and you take care of them, they will last a long time. In fact, it is not a bad idea to have a couple of pairs of tweezers even with their durability and enduring nature. This is because tweezers can come in handy at any time, not just when you are prepping your face for makeup, or in the morning after a shower. So if you keep one at home and one in your backpack or purse, you should be in good shape for any tweezer emergency that arises.

We did not test these tools because they were not tweezers, and were not necessary euro to south african rand exchange rate to the function of the FIXBODY tweezer. However, these included tools are a plus when considering the value of the tweezer set. The tweezer and two other comedone extraction tools were sold for under $10 for the whole set. If you have hairs that you need to be removed that grow in an inconvenient to reach location of your body, potentially the curved tip tweezer will help.

Contents:

Each trader has their own ideas on why prices go to a certain direction and where prices would go onward. Opinions from all traders in the world go together to create “market sentiment”. Last week saw the USD/JPY currency pair print another firm bullish candlestick, which closed right on its high. The US Dollar was again the strongest currency over the past week, while the Yen was the weakest, putting this pair in focus. As such, fundamental analysis plays an important role in influencing market sentiment.

Wait for the price to confirm the reversal before acting on sentiment signals. Currencies can stay at extreme levels for long periods of time, and a reversal may not materialize immediately. Significant sentiment data, based on a representative sample of 25 to 50 leading trading advisors for 5 years. Do not follow a single guru but rather a balanced group of well chosen experts. The Forex Forecast Poll offers a condensed version of several expert’s opinions. Only outlooks are considered that have been committed to publication and therefore have an influence on the market.

The sentiment indicator can be used especially in a conjunction with other trading signals and techniques to filter out false entries. Market Sentiment is an unofficial consensus among market participants related to market assets and the macroeconomy. This unofficial consensus is an accumulation of various fundamental and technical factors, including price patterns and the release of economic data or global news that are considered important. These factors together form the general perception of the investment market community. In forex trading, fundamental analysis focuses on key economic data to determine the strength of a currency.

For example, when equities decline in value, safe-haven assets – like gold, silver and the Japanese Yen – typically rise in price. So, sentiment is a useful factor to consider when starting a hedging strategy, as you’ll be able to find correlations that can offset risk from one position to another. Market sentiment is actually a popular indicator in itself for finding over and under-valued stocks. By understanding whether share prices are trading above or below their intrinsic value, speculators can take advantage of the movement and also capitalise on a reversal back toward a more accurate price.

It predominantly consists of speculators who have no interest in using the currency futures market for hedging purposes. Next, we will discuss the Commitment of Traders report, which is another useful forex sentiment analysis tool that can be used in your analysis. Market sentiment is one of the most popular ways of analysing trending markets and whether a stock is over or undervalued. Find out what market sentiment is and how it can be used in a trading strategy. IG Client Sentiment can be a useful tool to incorporate into your trading strategy.

Sentiment indicators show the percentage, or raw data, of how many traders have taken a particular position in any given currency pair. For example, if 60 out of 100 are long and 40 short on that same currency pair then technically you could say sentiment is bullish for this trade at 60%. Combining forex sentiment analysis with other means of analysis can greatly help in determining the overall mood of market participants and the possible future direction of a currency pair. Many forex brokers offer position summaries that show the percentage of traders with long or short positions in each currency pair.

It works on the premise that a higher odd-lot short sale ratio identifies a Forex market bottom. There are a lot of efforts to gauge market sentiment with great accuracy, so there are a lot of various types of sentiment indicators. Some sentiment indicators, like volume ones, can be utilised for personal securities.

In this case, when the British pound futures market declined, the open interest steadily increased, which revealed a strong bearish sentiment over the marked time period . As a novice forex trader, it is important to be aware of market sentiment because it can have a big impact on currency prices. Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

https://traderoom.info/ are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Wall Street-bearish contrarian trading bias. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger US 500-bearish contrarian trading bias. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/JPY-bearish contrarian trading bias. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/GBP-bearish contrarian trading bias. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

The https://forexhero.info/ is only gathered from clients of that broker, and therefore provides a microcosmic view of market sentiment. The sentiment reading published by one broker may or may not be similar to the numbers published by other brokers. If, say, the AUD/USD currency pair is trending higher, looking to open interest in Australian dollars futures provides additional insight into the pair. Increasing open interest as the price moves up indicates the trend is likely to continue.

USD/JPY Technical Analysis: Eyes on Psychological Top 140.00.

Posted: Mon, 27 Feb 2023 04:14:33 GMT [source]

They can provide you with an insight into the underlying power of market movements. We advise you to look for extreme readings as a signal that prices are set to reverse. By understanding all that is mentioned above, you will understand what is market sentiment. Make sure to also learn about how volatility protection keeps you safe from volatility risks.

The reason is that the indicators signal the local market situation at the current time, while most traders expect a long-term downtrend. It means that the uptrend is exhausting, and when the market sentiment goes below 50/50, the trend will reverse down. Before opening a position, confirm the trading idea by oscillators or other technical tools. The sentiment analysis is displayed based on open positions of the LiteFinance traders, therefore the values are always relevant.

For example, the EURUSD market sentiment is 71.9% bearish, and you can enter a sell trade by clicking on the Sell button below. This function allows you to manage multiple transactions for several currency pairs. Understanding forex market sentiment and how it can be used to determine which direction a currency pair might take is an important and very useful tool to make better trading decisions.

In closing market sentiment is extremely important to track on a regular basis by forex trader and is a fantastic tool for a trader to use to gain an upper hand on their competition. Once a forex trader has a strong understand in how market sentiment works they should use this tool as an additional forex trading strategy. To develop a market sentiment approach, it is practical that the forex trader gauge and determine how the market is feeling. To take this approach, there are numerous economic market indicators to assist forex traders in determining the overall direction of the market. There are a lot of sentiment indicators and nearly endless ways to interpret them.

Adapt or die and having the ability to correctly conduct sentiment analysis will help you on the path to becoming a consistently profitable Forex trader over the long term. Unlike a stock exchange where all trading volume goes through a centralized server, the Forex market’s decentralized nature makes viewing an order book more complex. While you’re not getting an entire market view, you are receiving a representative sample size that statistically can be used to make trading decisions.

Forex Today: Powell Triggers Bullish Sentiment.

Posted: Thu, 02 Feb 2023 08:00:00 GMT [source]

The purpose can be described as the following; when you look at sentiment in the Forex market, you want to see what investors’ thoughts are on the market. Undoubtedly one of the oldest sentiment surveys is the American Association of Individual Investors, also known as the AAII Sentiment survey. 73.05% of investors lose money when trading CFDs with FXCM Enhanced Execution and pricing. The reemergence of USD strength sent EUR/USD back below 1.06, which has coincided with a slight build in long positions on the euro – EUR/USD positions increasing from 59% to 63% long among IG clients.