- +39 3406487807

- studioartem@studioartem.it

This often involves analyzing trends and ratios and comparing historical data to detect inconsistencies. Someone might want to use a forensic accountant to investigate sources of lost funds if they suspect that fraud has occurred or if there is any suspicion of misappropriation of funds. Forensic accountants can use their expertise and investigative techniques to uncover the source and amount of lost money, which can help prevent future losses. Additionally, this type of investigation can also be useful in assisting in the design and implementation of internal controls for businesses. With global fraud losses estimated at 5 trillion annually, the need for reliable forensic accounting services is on the rise. Furthermore, they can help businesses investigate and prevent fraud and identify tax evasion and other financial crimes.

In some cases, this service also allows the insurance company to review the claim submitted by the policyholder to quantify the claim amounts. Ask a question about your financial situation providing as much detail as possible. Their adherence to these procedures not only makes their work more systematic and comprehensive but also enhances its acceptance in the legal sphere, where procedural correctness is paramount. They also use investigative methods such as interviews, surveillance, and public record searches to gather information related to the case.

Forensic accounting is the process of reconstructing a business’ financial history to determine whether it has been fraudulent. This can be done by analyzing the company’s financial records, including accounts receivable, accounts payable, and inventory. Forensic accountants collect and analyze financial data, records, and transactions. They review financial statements, invoices, bank statements, and relevant documents to trace irregularities. Their work covers Certified Bookkeeper a wide range of financial crimes, including fraudulent financial reporting, asset misappropriation, money laundering, and bribery. They bring their razor-sharp analytical skills and deep understanding of accounting standards to identify and investigate any irregularities in financial reports.

This guide explores how to create a solid budget, track expenses, manage cash flow, and set financial goals. Learn practical strategies to optimize your resources, minimize unnecessary costs, and ensure financial stability for sustainable growth. Proper planning and financial management pave the way for better profitability and long-term success. According to a report by Allied Market Research, the global forensic accounting market is projected to reach $11.68 billion by 2031.

Several high-profile cases have demonstrated the importance of forensic accounting. For example, the infamous Enron scandal, which led to the company’s bankruptcy, was uncovered through forensic accounting techniques that exposed fraudulent accounting practices. This case, among others, underscores the need for skilled forensic accountants in protecting businesses from financial misconduct. It involves examining a company’s financial records, often focusing on identifying misstatements or fraudulent entries.

Given their travel arrangements, these accountants are more similar to consultants than auditors, who are less likely to travel on a regular basis. In the healthcare sector, forensic accountants investigate cases of fraud involving insurance claims, billing practices, and financial mismanagement. Their work helps ensure that healthcare providers remain accountable and that funds are used appropriately. For example, cases involving international transactions, offshore accounts, or intricate financial schemes require forensic accountants to have specialized knowledge and expertise.

Additionally, they may employ analytical methods like Benford’s law which allows them to predict patterns in data that may be predictive of misconduct. The accuracy and success of a forensic accounting project will depend on accurate data collection and careful analysis by qualified professionals. Through legal skills, forensic accountants can determine if a financial activity is illegal. Forensic accounting encompasses providing litigation support and investigative accounting services to uncover suspicious financial activities such as money laundering, fraud, and tax evasion.

Forensic accounting is a specialized area of accounting that focuses on investigating financial crimes, disputes, and other irregularities. The investigation and verification are normally done on the company’s financial statements, management accounts, and other related documents, data, and information related to the investigated subject matter. Forensic Accounting is the art of investigating accounting records, financial statements, and other related financial records. The result of the investigation is mostly used for legal support and resolving conflict. Being attuned to these legal dimensions helps forensic accountants ensure their findings are both accurate and admissible in court, thus enhancing their effectiveness in the legal arena. Using their accounting knowledge and investigative skills, they identify and analyze indicators of fraud, such as suspicious transactions, unusually high expenses, and sudden changes in financial behavior.

Connect with an Advisor to explore program requirements, curriculum, credit for prior learning process, and financial aid options. We have been working with Jack Ross for over two years and the service has been fantastic. They have a great and knowledgable team who have taken good care of us and our accounts.

Forensic accountants provide valuable insights in each of these scenarios that can help legal teams build their cases and resolve disputes efficiently. Salaries may depend on what sector the accountant works in; for example, the BLS states that accountants working in finance and insurance had higher average salaries than those working in government. Forensic accountants also tend to make more than a typical accountant; ZipRecruiter reports the average forensic accountant salary is $93,527. Bureau of Labor Statistics (BLS) does not have data on forensic accounting salaries specifically, it reports that the average wage for all accountants was $86,740 as of May 2022. Forensic accountants identify illegitimate sources of money – money laundering practices and undisclosed bank accounts.

Content

fund accounting includes giving accounting for portfolios of investment such as securities, commodities, real estate, etc. Let’s look at what accounting is before we dive into fund accounting. In fact, accounting principles mimic real life processes of how money comes in and out of your pockets.

While the Generally Accepted Accounting Principles (GAAP) are still followed, there are significant differences in how financial transactions and balances are recorded. Net asset value or NAV is the company’s total asset value less its liabilities. Assets are what the fund owns and liabilities are what the fund owes. Fund accountants are responsible for timely and accurate execution and reporting of net asset valuations for the client’s accounts. Private equity fund accounting should accommodate privately held companies since private equity funds are not traded publicly.

For example the church may want to know how the giving for the General fund has increased or decreased over the last five years. Some times the pastors are on the church board so they can get a first hand look at what is happening, financially. Some times they are not, but that doesn’t dismiss them from knowing what is going on financially, at a high level. Pastors get asked many times in passing conversations, how certain projects and missions are going. So it is important that they are tuned in to the organization’s finances, and not turn a blind eye to it because someone “else” takes care of it. Pastors (IE — fathers, priest, deacons, bishops, and so on) are the face of the church, so to speak.

For example, the following statement of financial position breaks down monies by liabilities and assets as well as restricted and unrestricted funds. They should not have monies entered for things like room rentals, wedding fees, or other income producing activities that aren’t pure donations. Accounting funds on the other hand can receive money from donations, and all other income producing activities. For example, when recording room rental fees, money received should bypass the donation funds completely. This increases the church’s checkbook, but gives no credit to donors because room rental fees aren’t donations.

People like the church board, financial secretary, pastor, and donors. We will go over why each of these would need to understand https://www.bookstime.com/articles/what-is-cost-accounting-and-how-does-it-work. We’ll also cover why they might have different purposes in their queries about the financial health of the organization. It uses self balancing funds which gives accountability to their donors (or grant authority, or governing agency). These donors have placed restricted or unrestricted limitations on their donations. This answers why this type of revenue was received and the type of expense incurred.

This article covers the fund accounting basics, from the fund accounting meaning and differences with traditional accounting, to fund accounting use and frequently asked questions. Fund accounting is generally used by any organization that focuses on accountability rather than profitability. This includes nonprofit organizations, government entities, churches, and associations. When using the fund accounting method, an organization is able to therefore separate the financial resources between those immediately available for ongoing operations and those intended for a donor specified reason.

Fund accountants work for nonprofits, governments, or churches, helping them manage their day-to-day bookkeeping operations. They may also provide tax and accounting services, assisting organizations in preparing financial reports for the IRS and making better decisions for their future work. Fund accountants can also refer to accountants responsible for managing mutual and institutional funds. They help these businesses manage their everyday accounting tasks and prepare financial statements.

Without them, it’s difficult to pinpoint your business’s financial health and has you making critical decisions in the dark. The frequency at which catch up bookkeeping should be performed varies based on the complexity and scale of business transactions. Some businesses may find it necessary to conduct catch ups, while others may find reviews sufficient. If you need to catch up on your bookkeeping, hiring a professional bookkeeper is important. When you need to catch up on your bookkeeping, tracking your income and expenses can be difficult.

The magic happens when our intuitive software and real, human support come together. Book a demo today to see what running your business is like with Bench.

This can include scanning physical documents, converting them to digital files, and organizing them in a cloud-based storage system. Establish internal controls to safeguard against errors, fraud, and misuse of financial resources. Segregate duties, limit access to sensitive information, and implement approval processes for financial transactions. If you’re unsure about whether a purchase qualifies a deductible business expense, learn how the IRS differentiates personal and business expenses. If you need to separate your business and personal expenses, the sooner you do it, the better. Learn how to open a small business bank account and keep your finances separate.

Save more by mixing and matching the bookkeeping, tax, and consultation services you need. Whether doing it yourself or hiring a pro, catching up on accounting can be costly and time-consuming. The amount of work needed will vary depending on how far behind you are, but it’s important to understand the upfront investment involved. Some businesses with several transactions or complex financial structures need weekly catch-up sessions.

Many small business owners will hire an expert to address their bookkeeping issues. This ensures your transactions are correct and allows you to catch any mistakes that may have been made in previous steps. Once you understand your financial status, you must gross vs net organize and categorize that data. Focus on organizing receipts and invoices where you can access them when needed. Using accounting software, such as 1-800Accountant’s ClientBooks, is among the quickest and most secure methods of categorizing and storing your data.

For the first few years, she managed her finances on her own using spreadsheets and simple accounting software. However, as her business grew, her transactions became more complex, and she found herself falling behind on her bookkeeping. By the time tax season rolled around, she was months behind on updating her records. After organizing the records, it’s time to begin the reconciliation process. This involves matching the transactions on your bank and credit card statements to your financial records, ensuring that everything is accounted for. If you’re missing transactions, now is the time to find and record them.

This will make catch up bookkeeping it easier to input the information into your bookkeeping software. Additionally, if you started a new vertical in your business, you may want to track their profitability separately; then, you also need to realign your numbers to reflect the new reality. Ensuring that all financial records are current and complete is crucial as part of the clean-up bookkeeping process. Reconciling receipts for all modes of payment is essential for accurate bookkeeping and reporting. To avoid falling behind, it’s essential to establish a regular routine for updating your records. Setting aside time weekly or monthly to track transactions can help maintain accuracy.

Content

A semi-mixed cost cost, also known as a semi-fixed cost or a mixed cost, is a cost composed of a mixture of both fixed and variable components. Costs are fixed for a set level of production or consumption, and they become variable after this production level is exceeded. If no production occurs, a fixed cost is often still incurred. Mixed costs are a combination of your fixed and variable costs.

Finally, Jim wants additional sales to generate cash to reduce debt and generate a reserve. To successfully complete all of this, sales have to exceed $40,000 per month. First calculate the change in cost and the change in activity.

Since they differ based on output, it is more difficult to anticipate these costs when operating a restaurant. You’ll be able to predict each month’s events after a few months.

Examples of semi-variable costs include:Repairs and maintenanceTelephone billsElectricity costsVehicle expenses

In that case, one can predict how the costs will change at the different activity levels, and the decisions can be taken accordingly. Methods for separating mixed costs can be defined as the methods adopted by the business organization to separate the mixed cost into a variable or fixed cost. Examples of mixed costs include salaried workers who also receive commissions or work overtime and car expenses like a monthly lease and gas . Some expenses might have aspects of both fixed and variable costs. This kind of expense is known as a mixed, semi-variable, or semi-fixed cost. On the other hand, variable costs fluctuate based on your sales activity.

It also has a https://www.bookstime.com/ that stays as-is no matter what the level of activity is. The $400 is the fixed component as you’ll be paying for it no matter how many gallons of water you consume. Correct measurement of the mixed cost help companies to build proper budgeting and appropriate costing system. A cost that remains constant in total with changes in activity and varies on a per unit basis with changes in activity. A cost that varies in total with changes in activity and remains constant on a per unit basis with changes in activity. Direct labor and overhead are often called conversion cost, while direct material and direct labor are often referred to as prime cost.

In the long run, if the business planned to make 0 shirts, it would choose to have 0 machines and 0 rooms, but in the short run, even if it produces no shirts it has incurred those costs. If the revenue that they are receiving is greater than their variable cost but less than their total cost, they will continue to operate while accruing an economic loss. If their total cost is less than their variable cost in the short run, the business should shut down.

In this method, just two data points are required to determine the mix of fixed and variable costs. This includes the fixed costs of rent, insurance, and salaries, as well as the variable costs of fuel multiplied by the number of miles driven. This graph shows that the company can’t completely eliminate fixed costs. Even if the company does sell or produce a single product, there will still be fixed costs. Since mixed costs have characteristics of both fixed and variable costs, they are usually separated into segments in order to be graphed.

Content

Although QuickBooks Self-Employed does have a P&L account, it does not include a balance sheet nor monitors liabilities and assets. Its dashboard provides an insight into profits and losses, invoices, accounts as well as estimated tax. Quickbooks Self-Employed allows you to send invoices to clients, if necessary. For first time clients, you’ll have to enter details manually, but the software will have autofill features for those that are recurring. Software Advice’s FrontRunners report ranks top products based based on user reviews, which helps businesses find the right software. Small Business Computing addresses the technology needs of small businesses, which are defined as businesses with fewer than 500 employees and/or less than $7 million in annual sales.

Hugh Wilson writes about business and the interface of business and technology for a range of titles including The Guardian, Telegraph, Independent, The Times, BBC and MSN. He has written a large number of articles for Top Ten Reviews about insurance matters, accounting, and some business-to-business software and appliances. It’s worth reiterating that Intuit QuickBooks Self-Employed is a financial organization tool for the smallest of small businesses, and doesn’t claim to be anything like a full accounting solution.

Freelancers, including collaborative economy workers, tend to have some unique financial management concerns and tax obligations. For example, they tend to use the same accounts for both business and personal expenses, which can be hard to disentangle for the purpose of tax deductions when April rolls around. In addition, they may be working as a “business” for the first time, and may be confused about or unaware of their quarterly tax obligations, let alone how to estimate or pay them. Many have other, more traditional employment, and do this gig or on-demand work to complement their income. Finally, they may be forfeiting huge deduction opportunities simply due to lack of awareness.

That’s why most self-employed individuals muddle through with spreadsheets, a folder full of receipts, and a gut feeling about what to set aside for taxes each quarter. We at MISSION can help your young business or freelance operation with its accounting processes. Using more complex accounting software could make reconciliation confusing.

Users can also segment business and personal expenditures and share expense summaries. QuickBooks Self-Employed is not a full-featured accounting package and those looking for one should go elsewhere (its big brother – QuickBooks Online – isn’t a bad place to start). It is really a tool for the self-employed to track income and expenses and separate business from personal spending, calculate quarterly taxes and send invoices. It doesn’t offer double-entry accounting, and advanced features are thin on the ground. This software is specifically tailored to the needs of freelancers, independent contractors, gig-economy workers, and other self-employed individuals.

The Quickbooks Self-employed 2020 of this version of QuickBooks are intentionally limited to make it simple to use, but it does include a profit and loss report and estimates your tax liability. The service is also designed to integrate with Turbo Tax Home and Business, which should make tax filing extremely easy. Intuit QuickBooks Self-Employed’s mobile app lacks little—if anything—found on the browser-based version. It’s the best companion app I found in this group of accounting websites designed for freelancers.

Content

Sales Tax and VAT is not your money so it should never be included. Turnover To Date means the turnover so far this financial year. From this you can start to make a prediction of your total turnover for the year. For example, if you’re 9 months into your year and your turnover to date is 75,000, then you can predict with some https://www.good-name.org/how-accounting-services-can-help-real-estate-companies-optimize-their-finances/ degree of certainty that your total turnover for the year will be 100,000. This might mean your net profit is low or negative, but will hopefully pay off in the future with a healthy net profit. If your business is more mature and still operating with a low or negative net profit, that may mean something needs to change.

This will allow you to work out where you’re making profit (and where you’re losing it). Finally, gross profit can help you secure funding from investors or lenders. If your gross profit margins are healthy and trending in the right direction (up!), then you’ll have a much better chance of getting the funding you need to grow your business. Net profit is also an important indicator of a company’s financial health and is typically what’s reported on a company’s income statement. A healthy net profit margin indicates that a company is profitable and has room to grow.

What ‘good’ looks like here very much depends on the size of your business. Your net profit percentage is likely to reduce as your business grows. This is because you’ll add more operating expenses that you don’t need when you’re smaller, e.g. offices, non-chargeable staff, infrastructure, etc. As discussed https://azbigmedia.com/real-estate/how-do-real-estate-accounting-services-improve-clients-finances/ above, a company’s gross sales are calculated by deducting cost of goods sold from total sales revenue. Whereas net sales are calculated by deducting discounts, allowances and returns from gross sales. The proportion of net sales to gross sales may be of interest to internal and external stakeholders.

For example, you will deduct expenses like overhead, the cost of goods sold, and other variable expenses. Reporting net revenue is going to reflect the total profit of your business over a period. It’s a simple process to calculate and report gross revenue. And making use of small business accounting software can make it even easier.

National Insurance – a form of income tax which is used to contribute towards state pension and social security payments. Net profit is the sales income minus all the business costs. Gross profit is the sales income minus the direct costs of getting the article to sale. Net profit is the selling price of your good minus ALL the costs of running your business. This is the figure that we usually mean when we refer to profit (but it’s always worth checking). A gross rental yield is typically used by a more experienced investor who can quickly assess the expected costs, but uses the gross rent as a good indicator of an investment.

If you’re making repayments on a student loan, this will be shown on your payslip. My question is with regards to the profitability of the business. Revenue is simply the total amount of income your company generates from the sale of your products or services.

Ultimately, each business needs to determine what profit margin is right for them based on their individual circumstances. Claire works in an office and earns a salary of £35,000 per year. She has additional income from a rental property and she also recently sold some old clothes online. Claire’s gross pay is her salary of £35,000 + £12,000 rental income + £500 from selling the clothes. Gross profit is the profit a company makes after deducting production costs, and net profit is the profit you have left over after deducting all expenses — insurance, taxes, wages etc. A small business owner will know that failing to recognise the difference between gross versus net can have consequences for their growing business.

You could have positive gross profit, but your net profit margin could be low or even negative. This would mean that you’re making enough money to cover the cost of production of your products/delivery of your services, but not enough money to support your business as a whole. A company operates a factory which employed 40 direct workers throughout the 4 week period just ended.

It might also show repayment of season-ticket loans, cycle-to-work scheme loans and charitable donations (using the give-as-you-earn scheme). This will usually be shown as a separate figure – any Statutory Sick Pay is likely to be deducted real estate bookkeeping from occupational sick pay. If you’re paying towards a workplace pension that your company has set up or arranged access to, the amount you’re contributing will be shown. Your employer might pay any expenses owed to you via the payroll.

Content

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Companies may choose to use their retained earnings for increasing production capacity, hiring more sales representatives, launching a new product, or share buybacks, among others. To learn more and say goodbye to crunching numbers, scrolling spreadsheets, and losing your sanity. Regardless of the budgeting approach your organization adopts, it requires big data to ensure accuracy, timely execution, and of course, monitoring. Divvy’s expense management software simplifies the invoice capturing process by doing all the hard work.

Retained earnings are the profits that remain in your business after all expenses have been paid and all distributions have been paid out to shareholders. Retained earnings is derived from your net income totals for the year, minus any dividends paid out to investors. If you’re a private company, or don’t pay shareholder dividends, you can skip that part of the formula completely. If the company expects more https://personal-accounting.org/ investment Opportunities and will earn more than its cost of capital, then it would intend to retain the funds instead of paying dividends. DividendsDividends refer to the portion of business earnings paid to the shareholders as gratitude for investing in the company’s equity. Whenever a company generates a surplus, it always has an option to pay a dividend to its shareholders or retain it with itself.

Both revenue and retained earnings are important in evaluating a company’s financial health, but they highlight different aspects of the financial picture. Revenue sits at the top of theincome statementand is often referred to as the top-line number when describing a company’s financial performance. Retained earnings are also called earnings surplus and how to calculate retained earnings without net income represent reserve money, which is available to company management for reinvesting back into the business. When expressed as a percentage of total earnings, it is also called theretention ratio and is equal to (1 – the dividend payout ratio). Retained earnings are the cumulative net earnings or profits of a company after accounting for dividend payments.

Retained earnings (RE) may also be referred to as unappropriated profit, uncovered loss, member capital, earnings surplus, or accumulated earnings.

Retained earnings provide you with insight into your cumulative net earnings. But several financial statements need to be prepared to calculate retained earnings. One of them is the income statement, and you’ll need to process expenses to put this statement together. The cost of retained earnings is not equal to zero because it represents the return shareholders should expect on their investment. There’s an opportunity cost since the earnings could be invested in the market instead of building on the company’s balance sheet. Companies typically calculate the opportunity cost of retained earnings by averaging the results of three separate calculations. The cost of those retained earnings equals the return shareholders should expect on their investment.

At the end of every accounting period , you’ll carry over some information on your income statement to your balance sheet. On the other hand, though stock dividends do not lead to a cash outflow, the stock payment transfers part of the retained earnings to common stock. For instance, if a company pays one share as a dividend for each share held by the investors, the price per share will reduce to half because the number of shares will essentially double. Because the company has not created any real value simply by announcing a stock dividend, the per-share market price is adjusted according to the proportion of the stock dividend. To calculate retained earnings, start with the company’s net income figure for the period in question. From there, subtract any dividends that were paid out during that period. This figure can then be added to the retained earnings figure from the previous accounting period.

Retained earnings can typically be found on a company’s balance sheet in the shareholders’ equity section. Retained earnings are calculated through taking the beginning-period retained earnings, adding to the net income (or loss), and subtracting dividend payouts.

To find it, you’ll note changes in a company’s stock price against the net earnings it retains. You’ll record such expenses in your books and accounts as net reductions, as they result in a direct company loss of liquid assets. Therefore, a company’s retained earnings, revenue, and net income are all good indicators of its financial health. Just like with any financial metric, retained earnings should not be considered in isolation. For example, an acceptable range of values will depend not only on the industry and business model but also on the company’s current maturity or status. In such cases, retained earnings are the remaining income after the distribution of shareholder dividends. These earnings reflect the extent of a company’s ability to save net income.

Likewise, the traders also are keen on receiving dividend payments as they look for short-term gains. In addition to this, many administering authorities treat dividend income as tax-free, hence many investors prefer dividends over capital/stock gains as such gains are taxable. Retained earnings refer to the residual net income or profit after tax which is not distributed as dividends to the shareholders but is reinvested in the business. Typically, the net profit earned by your business entity is either distributed as dividends to shareholders or is retained in the business for its growth and expansion. Sometimes when a company wants to reward its shareholders with a dividend without giving away any cash, it issues what’s called a stock dividend. This is just a dividend payment made in shares of a company, rather than cash.

But Fundera reports that “about 20% of small businesses fail in their first year,” and 50% close up by year five. Boost your chances of success by learning how to find retained earnings—your business’s profits minus shareholder payments. While a trial balance is not a financial statement, this internal report is a useful tool for business owners. It is also used at audit time to see the impact of proposed audit adjustments. If your business currently pays shareholder dividends, you simply need to subtract them from your net income.

Here’s everything you need to know about this new informational IRS form. The right financial statement to use will always depend on the decision you’re facing and the type of information you need in order to make that decision. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

A Closer Look At Fleury’s Impressive ROE.

Posted: Wed, 04 Jan 2023 09:16:53 GMT [source]

This profit can be paid to shareholders but is also often used to reinvest in the business. This can be a positive or negative number, depending on business performance the prior year. We’ll show you how to calculate retained earnings with the formula below. A cash dividend is the major factor that affects retained earnings calculation. When you make cash dividend payments to stakeholders, it reduces retained earnings.

For example, a small business that manufactures widgets may have fixed monthly costs of $800 for its building and $100 for equipment maintenance. These expenses stay the same regardless of the level of production, so per-item costs are reduced if the business makes more widgets. Cost of goods sold is usually the largest expense on the income statement of a company selling products or goods. Cost of Goods Sold is a general ledger account under the perpetual inventory system. Note 1.43 “Business in Action 1.5” details the materials, labor, and manufacturing overhead at a company that has been producing boats since 1968.

This account balance or this calculated amount will be matched with the sales amount on the income statement. It is likely that you will have to estimate the cost of these activities. Next, you will need to allocate the cost of the activities to the individual products. Estimates and allocations based on logical assumptions are better than precise amounts based on faulty assumptions.

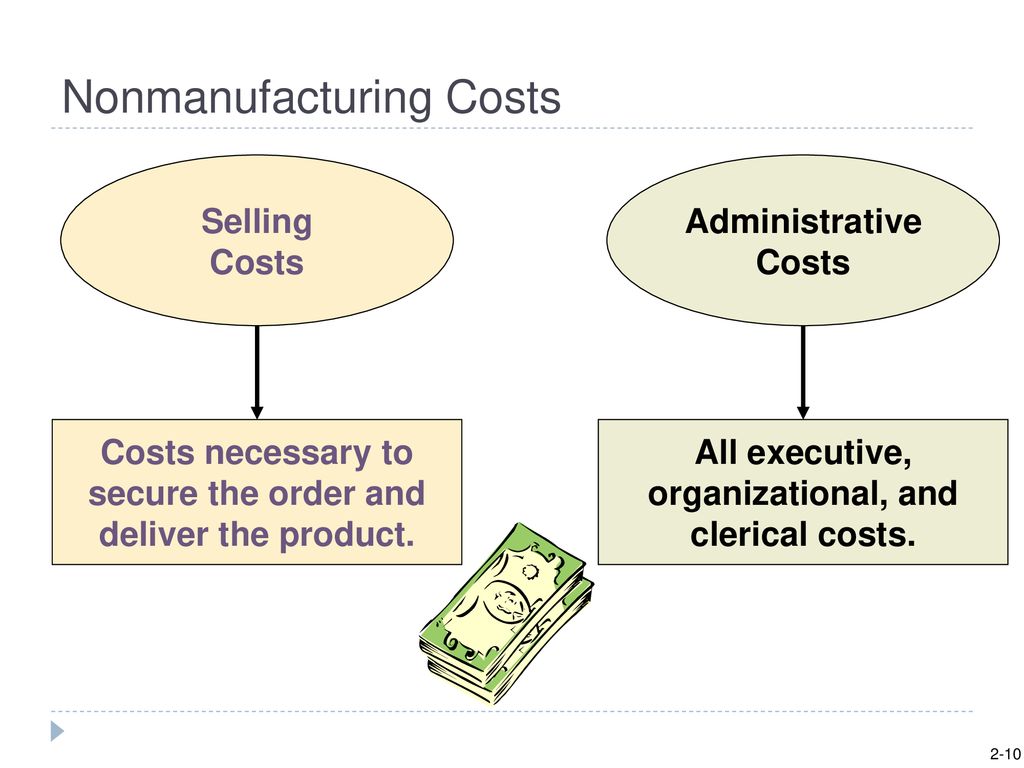

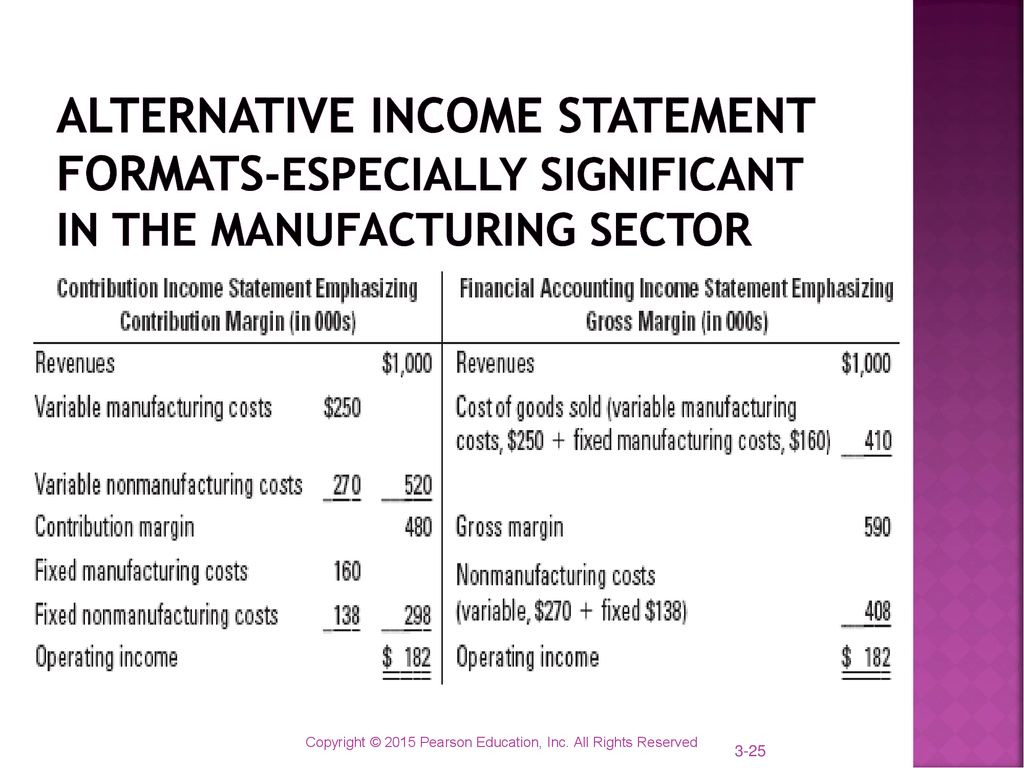

Executive salaries, clerical salaries, office expenses, office rent, donations, research and development costs, and legal costs are administrative costs. Since nonmanufacturing overhead costs are outside of the manufacturing function, these nonmanufacturing costs are immediately expensed in the accounting period in which they are incurred. That is why accountants refer to nonmanufacturing costs as period costs or period expenses. Although selling costs and general and administrative costs are considered nonmanufacturing costs, managers often want to assign some of these costs to products for decision-making purposes. For example, sales commissions and shipping costs for a specific product could be assigned to the product.

Indirect labor (part of manufacturing overhead) includes the production supervisors who oversee production for several different boats and product lines. In summary, product costs (direct materials, direct labor and overhead) are not expensed until the item is sold when the product costs are recorded as cost of goods sold. Period costs are selling and administrative expenses, not related to creating a product, that are shown in the income statement along with cost of goods sold. Direct labor manufacturing costs is determined by calculating the cost of employees directly responsible for producing the product. For example, a clothing manufacturer considers employees that dye the cloth, cut the cloth and sew the cloth into a garment as direct labor costs. However, designers and sales personnel are considered nonmanufacturing labor costs.

While this is a simplified view of direct labor calculation, accountants also include the benefits, overtime pay, training costs, and payroll taxes when calculating the hourly rate. To ensure that you understand how and why product costing is done in manufacturing companies, we use many manufacturing company examples. However, since many of you could have careers in service or merchandising companies, we also use nonmanufacturing examples. For a further discussion of nonmanufacturing costs, see Nonmanufacturing Overhead Costs.

Now, add the value of existing inventory to the cost of purchasing new inventory to calculate the cost of direct materials. Start by making a list of all the direct materials that are used to make the specific product and obtain the cost information for the direct materials you have identified. To calculate the cost of direct materials taxpayers have more time to file in 2017 you need to know the cost of inventory. According to a study conducted by McKinsey, these indirect costs account for 8% to 12% of the overall manufacturing costs. According to McKinsey’s research, cutting down manufacturing costs, in addition to boosting productivity, is the key for manufacturing companies to remain competitive.

Note “Business in Action 2.3.2” provides examples of nonmanufacturing costs at PepsiCo, Inc. Note 1.48 “Business in Action 1.6” provides examples of nonmanufacturing costs at PepsiCo, Inc. Material costs are the costs of raw materials used in manufacturing the product. By calculating manufacturing costs, manufacturers can better understand the elements that are driving up costs while identifying the most economical way to manufacture a product.

This helps them understand the most efficient process and the investment they need to make for the selected process. A manufacturing company initially purchased individual components from different vendors and assembled them in-house. As the company decided to assemble the components themselves, they found that the costs of managing the assembly line and the transportation were increasing significantly. According to the book Manufacturing Cost Estimating, the benefits of calculating the costs of manufacturing range from guiding investment decisions to cost control. The opportunity to achieve a lower per-item fixed cost motivates many businesses to continue expanding production up to total capacity. Cost is a financial measure of the resources used or given up to achieve a stated purpose.

To obtain these details, you can refer to the company’s employment records that has a list of all the employees and their hourly rates. For instance, let’s say a company has an existing inventory worth $1,500. A project cost overrun happens when the project costs exceed the budget estimate. That’s why you need a reliable partner to buddy up with and slash your costs.

Nonmanufacturing overhead costs are the company’s selling, general and administrative (SG&A) expenses plus the company’s interest expense. MasterCraft records these manufacturing costs as inventory on the balance sheet until the boats are sold, at which time the costs are transferred to cost of goods sold on the income statement. PepsiCo, Inc., produces more than 500 products under several different brand names, including Frito-Lay, Pepsi-Cola, Gatorade, Tropicana, and Quaker.

After subtracting the manufacturing cost of $10, each widget makes $90 for the business. Direct materials are those materials used only in making the product and are clearly and easily traceable to a particular product. For example, iron ore is a direct material to a steel company because the iron ore is clearly traceable to the finished product, steel. In turn, steel becomes a direct material to an automobile manufacturer.

Additionally, cloud computing reduces the need for physical storage and infrastructure maintenance, lowering the overall costs for businesses. If you’re big enough that you’re considering a liabilities in accounting controller but not big enough to need one full-time, an outsourced controller might be the right move. The roles you can outsource include tax accounting, bookkeeping, management accounting, payroll processing, financial data analytics, and Chief Financial Officer (CFO) for financial leadership services.

This collaboration enables businesses to focus on growth and development opportunities while maintaining confidence in the accuracy and compliance of their financial records. Understanding the nuances of accounting outsourcing is essential for businesses considering this approach. The key to a successful outsourced accounting partnership lies in selecting the right provider that aligns with your company’s specific needs and goals.

Now that the cost of outsourcing is less than the pay of one financial executive, many companies are beginning to outsource their finance and accounting operations more frequently. Cutting overhead and getting better financial leadership is critical to the success of all companies. By understanding where the industry is currently and where it is moving, you’ll be able to decide whether outsourcing is the right decision for your business. Financial planning and accounting are two critical components of running a successful business. This article will guide you through the concept of outsourced finance and accounting services, discuss the latest trends, and help you understand how to outsource these services. As you navigate the complexities of your startup’s financial landscape, remember that finance and accounting outsourcing is more than just a convenience.

And since your team may be working from a different time zone, you may be able to extend your company’s operational hours and further boost your financial activities’ efficiency. Let’s take a look at the most significant benefits of outsourcing finance and accounting. Whether you’re a startup aiming to minimize overhead costs or a seasoned enterprise seeking to focus on core competencies, bookkeeping questions and answers outsourcing finance and accounting offers a myriad of benefits.

Companies have a global pool of experts to tap into, and it has become easier for them to discover a finance and accounting partner that meets their needs. Recent trends have seen companies outsourcing more complex and valuable functions such as financial analysis, forecasting, and budgeting. Many younger companies and startups find it challenging to keep up with the complex nature of financial management or to find the necessary funds to develop an internal finance team. This leaves outsourcing as an attractive option over full-time house staff. When choosing an accounting outsourcing firm in the USA, consider factors such as industry experience, pricing structure, communication, and security. Look for a firm that offers relevant services, experience in your particular industry or sector, and transparent fees.

There are online/remote accounting firms, but based on their low reviews, we can’t recommend any of them in good conscience. BDO is the brand name for the BDO network and for each of the BDO Member Firms. BDO USA, P.C., a Virginia professional corporation, is the U.S. member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms. At BDO, you can do much more than fulfill your career ambitions — here, you can explore your full potential.

There is no shortage of anecdotal evidence target profit definition to suggest accountancy outsourcing is on the rise but a recently released study has revealed just how significant that rise is. By outsourcing these tasks, companies can focus on their core competencies, streamline their operations, and create a more transparent financial environment. As you grow, having a professional, outsourced accountant on your side gives you the advantage of proactivity rather than reactivity.

Content

Assume a http://kharchenko.com/date/aug/25.shtml has $950,000 net income, reported on the income statement. Retained earnings at the end of the accounting period will be increased with a credit of $950,000. The corresponding $950,000 debit is made to the income summary account, which closes the income statement for the period. The closing records income statement activity for the period on the balance sheet, using retained earnings. Note that the closing of the income summary is a process largely automated by accounting software. Utility payments are generated from bills for services that were used and paid for within the accounting period, thus recognized as an expense. The expense decreases equity by $300.

In other words, the purchased office equipment on account causes both sides of the equation balance out. Once you have recorded the supplies you purchased as an expense, the second part of the journal entry is ready to be entered. In this case, you cannot include an entry for supplies in the current assets section of the balance sheet because they are no longer considered assets. Basically, the assets are the resources that the company can use, including such things as fixed assets, inventory, cash, accounts receivable, and so on. The fundamental accounting equation is the foundation of the double-entry accounting system. Designed to ensure your books remain balanced, learn more about how to use the accounting equation in your small business. Property, plant, and equipment is the title given to long-lived assets the business uses to help generate revenue.

Marketable securities include short-term investments in stocks, bonds , certificates of deposit, or other securities. This information is very helpful and quite useful. The layout and step-by-step approach make it easy to follow and understand.

The first set of transactions , 1a, 2a, and so on, are repeated in the summary of transactions, Exhibit 2 . The second set of transactions (1b–6b) are repeated in Exhibit 4 . For every transaction, both sides of this equation must have an equal net effect. Below are some examples of transactions and how they affect the accounting equation.

https://aci-uk.com/2016/08/ Supplies, $2,200; Credit Supplies Expense, $2,200. You may have made a journal entry where the debits do not match the credits. This should be impossible if you are using accounting software, but is entirely possible if you are recording accounting transactions manually.

The at that time in the Common Stock ledger account is $20,000. Recall that the general ledger is a record of each account and its balance. Reviewing journal entries individually can be tedious and time consuming. The general ledger is helpful in that a company can easily extract account and balance information. Here is a small section of a general ledger. Cash was used to pay the dividends, which means cash is decreasing.

Are any items of value that your business owns. Your bank account, company vehicles, office equipment, and owned property are all examples of assets. Do not include leased items in your assets.

When equipment is purchased, it is not initially reported on the income statement. Instead, it is reported on the balance sheet as an increase in the fixed assets line item.

Since they were bought in cash, which means no liabilities were incurred, that means that the owner’s equity will also decrease. The sale of an asset on credit for what it cost a. Current assets typically include cash and assets the company reasonably expects to use, sell, or collect within one year. Current assets appear on the balance sheet in order, from most liquid to least liquid. Liquid assets are readily convertible into cash or other assets, and they are generally accepted as payment for liabilities. Cash includes cash on hand , bank balances (checking, savings, or money-market accounts), and cash equivalents. For example, the Cash account is an asset.

The ending balance for a revenue account will be a credit. You also have more money owed to you by your customers. You have performed the services, your customers owe you the money, and you will receive the money in the future. Debit accounts receivable as asset accounts increase with debits. You purchased the gas on account.