- +39 3406487807

- studioartem@studioartem.it

Content

Entry positions are highlighted in blue with stop levels placed at the previous price break. Take profit levels will equate to the stop distance in the direction of the trend. Key levels on longer time frame charts (weekly/monthly) hold valuable information for position traders due to the comprehensive view of the market. Entry and exit points can be judged using technical analysis as per the other strategies. This is much more conducive for beginners – as you can take your time researching the markets and thus – you can avoid having to make quick and instant decisions. In terms of forex swing trading strategies, a good starting point is to focus exclusively on financial news.

Day trading requires a trader to track the markets and spot opportunities that can arise at any time during trading hours. The Commodity Futures Trading Commission (CFTC) also warns prospective FX traders about rampant fraud in forex. Scams can involve pitches of low-risk, high-return currency strategies or promises to trade on the interbank currency market, among other things.

Scalping is an ultra-short-term strategy; positions might only be held for minutes as the trader capitalizes on small movements in exchange rates. Scalping and other short-term, high-volume approaches will have more risk, incur more fees and require more time and attention. Relevant factors for a positional forex trader include interest rates and monetary policy, long-term trends and historic pricing. Trading currencies can be complex, though this forex strategy has traders opening up one trade at a time, which can prevent them from overreaching and being exposed to a lot of risks. You need to apply technical analysis and fundamental analysis to use a Forex swing trading strategy.

The basic premise of a breakout strategy is to identify key levels where the price of a currency has repeatedly been tested but has been unable to break through in the past. The success of a breakout strategy depends on the trader’s ability to correctly identify key levels of support and resistance, and to enter and exit trades at the right time. Once you know your way around a pricing chart, you’ll be able to deploy some of the best forex day trading strategies utilized in the currency scene.

Once you find the usual top and bottom points, draw lines through them and treat everything that falls outside your two lines as a perfect buying/selling opportunity. Traders use the same theory to set up their algorithms however, without the manual execution of the trader. List of Pros and Cons based on your goals as a trader https://g-markets.net/helpful-articles/trend-trading-strategies-with-ig-client-sentiment/ and how much resources you have. The number of pips that the spread is quoting will tell you how much you need to make in a position to cover your costs. In this example, this means that your position needs to grow by 2 pips just to break even. If it increases by 3 pips, your net profit is 1 pip when factoring in the spread.

Unless you see a real opportunity and have done your research, steer clear of these. You’re probably looking for deals and low prices but stay away from penny stocks. These stocks are often illiquid and the chances of hitting the jackpot with them are often bleak. As a beginner, focus on a maximum of one to two stocks during a session.

A forex trading strategy is a technique used by a forex trader to determine whether to buy or sell a currency pair at any given time. No matter which forex trading strategy you choose to trade, risk management is still key. Our fourth and final simple forex trading strategy, is another price action based strategy. Our scalping trading strategy is based on the idea that we are looking to sell any attempt of the price action to move above the 200-period moving average (MA). Forex scalping is a popular trading strategy that is focused on smaller market movements.

Step into the realm of “Cross Currency Pairs / Cross Pairs” and discover new opportunities in forex trading beyond the popular… The goal of the strategy is to earn a profit from the interest rate differential between the two currencies. The carry trade strategy involves borrowing a low-yielding currency (e.g., from Japan) and converting it into a high-yielding currency (e.g., from New Zealand or Australia). That’s because it can help a trader to identify the short-term trading patterns and trends that are essential for day trading.

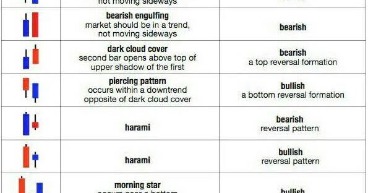

Forex day trading strategy is a trading technique used by forex traders to buy and sell currency pairs within a single trading day. The goal is to profit from short-term price movements by identifying and taking advantage of market trends. The strategy involves analyzing market data such as economic reports, news releases, and technical indicators to identify potential trading opportunities. Traders may use various technical analysis tools such as moving averages, trend lines, and chart patterns to identify trends and entry and exit points. Price action traders often use technical analysis tools such as support and resistance levels, trend lines, and candlestick patterns to analyze the market. They also pay close attention to price patterns, such as breakouts, reversals, and consolidations, to identify potential trading opportunities.

All the technical analysis tools that are used have a single purpose and that is to help identify the market trends. Perhaps the major part of Forex trading strategies is based on the main types of Forex market analysis used to understand the market movement. Forex beginners are always eager to learn forex trading online as an opportunity to make money, and they always wonder how to get started. It’s important to have a deep understanding of how the market works and… The world of Forex trading is like a vast ocean filled with currency fluctuations and market volatility. Without a trading strategy, it’s like setting sail without a compass or a map, leaving you at the mercy of the waves and winds.

Manually go through historical charts to find entry points that match yours. Determine whether the strategy would have been profitable and if the results meet your expectations. Not all brokers are suited for the high volume of trades day trading generates.

Swing trading is a speculative strategy whereby traders look to take advantage of rang bound as well as trending markets. By picking ‘tops’ and ‘bottoms’, traders can enter long and short positions accordingly. Trend trading is a simple forex strategy used by many traders of all experience levels. Trend trading attempts to yield positive returns by exploiting a markets directional momentum. There is no set length per trade as range bound strategies can work for any time frame.

Regular evaluation and reassessment of strategies are crucial to ensure that they are aligned with the changing environment and goals. Whenever you hit this point, exit your trade and take the rest of the day off. There are many candlestick setups a day trader can look for to find an entry point. If followed properly, the doji reversal pattern (highlighted in yellow in the chart below) is one of the most reliable ones.

The gist is that you use U.S. dollars to receive a different amount of another currency. These are companies or individuals who claim they can provide you with the latest price updates before everyone else gets them. You just need to give the broker some personal info and make a small deposit (sometimes that deposit is zero). All reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team. Neither our writers nor our editors receive direct compensation of any kind to publish information on tokenist.com. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website.

Timing of entry points are featured by the red rectangle in the bias of the trader (long). Traders can also close long positions using the MACD when the MACD (blue line) crosses over the signal line (red line) highlighted by the blue rectangles. Within price action, there is range, trend, day, scalping, swing and position trading. These strategies adhere to different forms of trading requirements which will be outlined in detail below. The examples show varying techniques to trade these strategies to show just how diverse trading can be, along with a variety of bespoke options for traders to choose from.

If the price breaks above the red and the blue line, you would watch and wait to see if it starts to move into the cloud as part of the strategy. If your mindset and emotions are under control, your chance of success dramatically increases. So, when choosing a Forex strategy to work with, make sure it fits your style and personality.

Don’t worry, you don’t have to be a mathematician—most forms of forex trading are relatively easy to get used to and that’s where trading strategies come in. Mastering a simple strategy will allow you to make correct predictions and profit most of the time unless a black swan event like COVID-19 happens. The key to being a successful trader is knowing how to predict whether prices are going up or down.

Millions have entered the market this year just in the U.S., and brokers are competing for their trust (and money). This competition has made the present moment a perfect time to start trading quickly and cheaper than ever. As mentioned above, position trades have a long-term outlook (weeks, months or even years!) reserved for the more persevering trader.